"经济衰退与大萧条"《世界首富》(三)

"经济衰退与大萧条"《世界首富》(三)

The Richest Man in the World

译文简介

1929年的大萧条就是这样一个例子,美联储的犹太所有者几乎无限量地扩大了货币供应,并以低利率宽松信贷,造成了巨大的泡沫,随后泡沫破裂。

正文翻译

(8) Recessions and Depressions

One of the nastier advantages of the foreign ownership of a country’s central bank is that the Jews have total control over those economies.

Since they control both the money supply and the interest rates, they have easily the power to whipsaw economies and profit immensely at every cycle. They do it the same way every time – by lowering interest rates to zero or nearly so, while hugely inflating the money supply, thereby creating large bubbles in debt, in the stock and housing markets, and so on. Then, they severely contract the money supply and all credit while simultaneously raising interest rates, thus bankrupting countless thousands of banks, businesses and families, and buying up for pennies on the dollar every manner of assets when the blood is running in the streets. After accomplishing their task of relieving a nation of a significant portion of its assets, they again expand the money supply and open the credit taps while reducing interest rates to give economies time to recover, then rinse and repeat. It is not a secret that all such recessions have been deliberately inflicted on Western economies by these Jewish bankers for the past 200 years or more.

8. 经济衰退和萧条

外国人拥有一个国家的中央银行的一个更糟糕的好处是,犹太人完全控制了这些经济体。由于他们同时控制着货币供应和利率,他们很容易就能在每个周期中扭转经济并获得巨大利润。他们每次都用同样的方式——将利率降至零或接近零,同时大幅增加货币供应,从而在债务、股票和房地产市场等领域制造巨大泡沫。然后,他们严重收缩货币供应和所有信贷,同时提高利率,从而使成千上万的银行、企业和家庭破产,并在一片废墟之时以极低的价格购买各种资产。在完成替换一个国家相当一部分资产的任务后,他们再次扩大货币供应,打开信贷龙头,同时降低利率,让经济有时间复苏,然后重复这一过程。在过去200年或更长的时间里,所有这样的衰退都是这些犹太银行家故意强加给西方经济的,这不是什么秘密了。

The 1929 Great Depression was one such, with euphoria based on the Jewish owners of the FED expanding an almost unlimited money supply and easy credit with low interest rates, building a huge bubble which was then burst. Thousands of banks, tens of thousands of companies, and millions of families, all went bankrupt, with all those assets mostly flowing eventually to the Jewish owners of the US FED and their closest friends. This was done many times prior to 1929, and has been done many times since. The bitterly savage recession in 1983 was similarly created by the US FED – on orders from the City of London, with Volcker even boasting openly about what he was doing. The 2008 housing and financial crisis in the US was identical, and in no way accidental. It was so bad that an executive of Goldman Sachs said at the time, “Things will never return to normal after what they have done.”

1929年的大萧条就是这样一个例子,美联储的犹太所有者几乎无限量地扩大了货币供应,并以低利率宽松信贷,造成了巨大的泡沫,随后泡沫破裂。成千上万的银行、成千上万的公司和数百万的家庭都破产了,所有这些资产最终都流向了美联储的犹太所有者和他们最亲密的朋友。这在1929年之前被做过很多次,之后也做过很多次。1983年那场惨烈的经济衰退也是由美联储一手造成的——那是伦敦金融城的命令,沃尔克甚至公开吹嘘自己在做什么。2008年美国的住房危机和金融危机如出一辙,绝不是偶然的。这是如此糟糕,以至于高盛的一位高管当时表示,“在他们做了这些事情之后,事情永远不会恢复正常。”

The collapsing of the industrial economies in 2022 is the same. A sudden and deliberately-contrived “energy shortage”, created in large part by the sabotage of Nordstream II, a reduction in the money supply, and the stiff raising of interest rates “to combat inflation” (which was entirely self-induced), and soon blood will be once again running in the streets. And an almost unlimited number of industrial corporations, especially in Germany but also in the weaker European nations, will be facing bankruptcy and takeovers, the news of which will never reach the public thanks to the almost-total media control by these same people.

2022年产业经济的崩溃也是如此。一场突如其来的、蓄意策划的“能源短缺”,很大程度上是由北溪二号的破坏,货币供应的减少以及“为了对抗通胀”而大幅提高利率(这完全是自我诱发的)造成的。很快,街头将再次沦为废墟。几乎不可计量的工业公司,特别是在德国,也在较弱的欧洲国家,将面临破产和收购,由于这些人几乎完全控制了媒体,这些消息将永远不会传到公众耳中。

There is no accurate way to definitively calculate the looting that takes place during these contrived “recessions”. 1929 was certainly in the trillions of dollars, as was 1983, which were perhaps the two worst, but the others weren’t so far behind. 2008 was also in this category, the housing losses alone being in the trillions, which I have included elsewhere. Given the lack of detailed data, I won’t try to isolate and estimate the financial result of each contrived financial recession, and will ignore the smaller ones, but that still leaves us with 1929 and 1983 being worth a very conservative $3 trillion each. It seems unreasonable for our purposes to not compound these two amounts with interest for the 90 years and 40 years respectively, but the totals become fantastic and almost incomprehensibly large, and thus very difficult to accept as rational. At 5%, $3 trillion in 90 years (since 1929) will accumulate to $240 trillion, and even over 40 years (1983) will become $21 trillion.

没有准确的方法可以确切地计算出在这些人为的“衰退”期间发生的抢劫。1929年肯定有数万亿美元,1983年也是,这可能是最糟糕的两次,但其他的也差不多。2008年也属于这一类,仅住房损失就高达数万亿美元,我已经在其他地方算过了。由于缺乏详细的数据,我不会试图孤立和估计每次人为的金融衰退的金融结果,也会忽略较小的金融衰退,但1929年和1983年的金融衰退仍然分别价值3万亿美元,这还是非常保守的。为了我们的目的,不把这两个数额分别计算为90年和40年的复利似乎是不合理的,但(如此一来,)总数就会变得不可思议,几乎大得难以理解,因此很难被认为是合理的。按5%计算,90年(1929年以来)3万亿美元将累积到240万亿美元,哪怕是1983年的经济劫掠,超过40年也将有21万亿美元。

Senator Robert Owen, a co-author of the Federal Reserve Act, testified before a Congressional Committee that the bank he owned received from the National Bankers’ Association the “Panic Circular of 1893.” It stated: “You will at once retire one-third of your circulation and call in one-half of your loans.” And that is how these central bankers create the recessions: an instant reduction of 35% or more in the nation’s money supply and a 50% reduction in total credit. The inevitable result is the bankruptcies of thousands of corporations and banks, and an enormous plunge in stock market values and corporate assets of every descxtion which are now available for pennies on the dollar. Wait ten years, and repeat. The purpose is the immense transfer of wealth available in each such cycle, and not only from small banks and corporations but from the general public as well, many of whom also lose everything they had, those assets eventually filtering up to the few oligarchy bankers who planned the events.

《联邦储备法》的合著者之一、参议员罗伯特·欧文(Robert Owen)在国会委员会作证说,他拥有的这家银行收到了来自全国银行家协会的“1893年恐慌通告”。上面写着:“你将立即收回三分之一的发行量,并收回一半的贷款。” 这就是这些中央银行家制造衰退的方式:国家货币供应立即减少35%或更多,信贷总量减少50%。

其不可避免的结果是成千上万的公司和银行破产,股票市场价值和各种各样的公司资产大幅下跌,而这些资产现在只需要几美分就能买到。等十年,然后重复。其目的是在每一个这样的周期中,财富的巨大转移,不仅来自小银行和公司,也来自普通公众,其中许多人也失去了他们所拥有的一切,这些资产最终流向了策划这些事件的少数寡头银行家。

记账:6万亿美元

(9) Looting the Oil Industry in 1983

As a detailed example, let’s look at the FED-induced 1983 recession and its effect on only the oil industry in North America. To begin, let’s assume we have an oil well with a constant steady production (which many are), but in this case of only one barrel per year for 40 years, with the oil price at $100 per barrel. That gives us a total value of $4,000. However, since $1 next year is worth less than $1 this year, we discount our future production at some interest rate, with this result in terms of value (if we want to sell our oil well):

0% – $4,0003% – $2,5006% – $1,50010% – $1,00025% – $400

9. 1983年洗劫石油工业

作为一个详细的例子,让我们看看1983年美联储引发的经济衰退及其对北美石油行业的影响。首先,让我们假设我们有一口产量稳定的油井(很多都是这样),在这种情况下,每年只有一桶,持续40年,油价为100美元/桶。我们得到的总价值是4000美元。然而,由于明年的1美元价值低于今年的1美元,我们以某种利率贴现(折扣)我们未来的产量,其结果是在价值方面(如果我们想出售油井): 0%——4000美元;3%——2500美元;6%——1500美元;10%——1000美元;25%——400美元。

Immediately prior to the 1983 recession, The New York Times proclaimed that a sudden and inexplicable “oil glut” had arrived, such that oil became nearly worthless, prices dropping from US$40 to less than $10 almost overnight. Of course, if the price of oil drops by 75%, the value of our oil well drops by 75% as well, so our $4,000 oil well is now worth only $1,000. But we had a double whammy, because the FED wasn’t idle during this period. After causing a massive burst of inflation in the 1970s to prepare for this eventual result, the FED suddenly felt a need to “fight inflation” by driving interest rates up to 20% and even 25%. The result was that oil wells were then selling at a discount of 25% on cash flow, and I know because at the time I was in the oil business and was buying and selling oil properties, some quite large, at this discount rate. This means that our $4,000 oil well, which was now worth only $1,000 due the collapse in the price of oil, was then hit with the FED’s interest rate sting, and was now worth only $100. And, with the blood running in the streets, this was when our Jewish Khazar bankers in the City of London sent in their agents to buy.

就在1983年经济衰退之前,《纽约时报》宣称,突然而莫名其妙的“石油过剩”已经到来,以至于石油变得几乎一文不值,价格几乎在一夜之间从40美元跌至不到10美元。当然,如果石油价格下跌75%,油井的价值也会下降75%,所以我们价值4000美元的油井现在只值1000美元。但我们遭遇了双重打击,因为美联储在此期间并没有闲着。为了应对这一最终结果,美联储在20世纪70年代引发了一场大规模的通胀爆发,之后它突然觉得有必要通过将利率提高到20%甚至25%来“对抗通胀”。结果是,油井以25%的折扣出售,我知道,因为当时我在做石油生意,以这个折扣率买卖石油资产,量相当的大。

这意味着,我们价值4000美元的油井,由于油价暴跌,现在只值1000美元,然后受到美联储利率的巨大打击,现在只值100美元。而且,当我们在伦敦金融城的犹太可萨银行家派他们的代理人来购买的时候,街上的鲜血正在流淌。

Then, the “oil glut” somehow miraculously evaporated and it seems we actually had a shortage, pushing the oil price back to its original $40, and quickly on its way to $100. And then, just as miraculously, inflation seemed to have been “tamed”, and interest rates declined from 25% back down to the 6% and 3% where they had been before. And our “$100 oil well” was back up to $2,500 and on its way to $5,000. And that means that a mere handful of people purchased producing oil and gas properties for almost pennies, and then watched their “investment” multiply by maybe 50 times. That’s not bad. There are few places where we can obtain a return of 5,000% on an investment in only a few years, and with no risk whatever. When you have the power to control the price of oil, and when you have the FED controlling interest rates, you can work miracles. There is no way to calculate accurate totals, but countless thousands of small and medium-sized oil companies either went bankrupt or were taken over, and the purchases in North America alone would have been in the trillions of dollars. I have ignored the rest of the world, and assumed a conservative $2 trillion for only North America, adjusted at a growth of 5% for 40 years from 1983.

Leger Entry: $14 trillion in today’s dollars

然后,“石油供过于求”奇迹般地消失了,我们似乎真的出现了短缺,将油价推回到了最初的40美元,并迅速向100美元上涨。然后,就像奇迹一样,通货膨胀似乎被“驯服”了,利率从25%下降到以前的6%和3%。我们的“100美元油井”价格回升到2500美元,并正在向5000美元上涨。这意味着,只有少数人以几乎几美分的价格购买了正在生产的石油和天然气物业,然后看着他们的“投资”增长了大约50倍。还不错。很少有地方可以在短短几年内获得5000%的投资回报,而且没有任何风险。当你有权力控制石油价格,当你有美联储控制利率,你就可以创造奇迹。没有办法计算出准确的总数,但成千上万的中小型石油公司要么破产,要么被收购,仅在北美的收购就会达到数万亿美元。我忽略了世界其他地区,并保守地假设仅北美地区就有2万亿美元,从1983年开始的40年里,增长率调整为5%。

记账:14万亿美元

(10) Looting Americans 1975 to 2022

The situation is not different with the 2008 financial meltdown in the US. We had clearly deliberate attempts to inflate the housing market to almost atmospheric levels, with nearly zero interest rates and the removal of all restrictions and requirements – to the point where unemployed homeless people were buying $500,000 homes. This was again done with the full cooperation of the FED. Then, they simply collapsed the bubble, resulting in tens of millions of foreclosures. And again, when the blood was running in the streets, firms like Blackrock and their ilk were busy buying up these foreclosed homes at perhaps half price, as rental properties – often, to the same people who lost them. There is no accurate record of the total purchases, but the buying was almost frenzied. At one point, one agent in Florida for one “investment firm” alone, was bidding on more than 200 homes per week. With even conservative estimates, the transfer of housing assets alone from the American middle class to these same few people, would have been $7 or $8 trillion, all within two or three years.

10. 从1975年到2022年掠夺美国人

这种情况与2008年美国金融危机没有什么不同。我们显然是故意将房地产市场膨胀到近乎大气的水平,几乎为零的利率和取消所有的限制和要求,以至于失业的无家可归者可以购买50万美元的房子。这同样是在美联储的全力配合下完成的。然后,他们简单地戳破了泡沫,导致数千万人丧失抵押品赎回权。再一次,当血流成河时,像贝莱德(Blackrock)这样的公司正忙着以半价买下这些止赎房屋,作为出租物业——通常是给失去它们的人。没有确切的购买总量记录,但购买几乎是疯狂的。曾有一段时间,仅佛罗里达州一家“投资公司”的一名经纪人每周就竞标200多套房子。即使是保守估计,仅从美国中产阶级向同样少数人转移的住房资产,就将在两到三年内达到7到8万亿美元。

It is a surprise to me that so few people seem to want to see such events as having been planned, and yet the evidence is overwhelming and irrefutable. There is no possibility that these events, and so many similar, could possibly have occurred “by accident”. There were simply too many threads all working together to accomplish this one result, and those threads could not possibly have been independent. And it is not possible that the US government itself was unaware of the eventual outcome. Economists working for the US government are not stupid, and so many private economists were describing the events and predicting the only possible outcome. The only thesis that fits all the facts is that the 2008 meltdown was planned and that the US government, so totally controlled from the City of London, knowingly permitted it to happen. Again, in summary, a relative handful of people profited to the tune of trillions of dollars in a few years, in this one enterprise alone.

令我惊讶的是,似乎很少有人愿意看到这样的事件是有计划的,然而证据是压倒性的,无可辩驳的。这些事件以及如此多的类似事件不可能是“偶然”发生的。有太多的线索一起工作来完成这个结果,而这些线索不可能是独立的。美国政府自己也不可能不知道最终的结果。为美国政府工作的经济学家并不愚蠢,许多私人经济学家都在描述这些事件,并预测唯一可能的结果。

唯一符合所有事实的论点是,2008年的金融危机是计划好的,而完全受伦敦金融城控制的美国政府,在知情的情况下允许它发生。总之,仅仅在这一个企业里,相对少数的人在几年内就获利了数万亿美元。

And it wasn’t only homes, and not only in 2008. In an article titled Destroyers of US Democracy Chris Hedges quoted a RAND corporation report that stated: “These establishment politicians and their appointed judges promulgated laws that permitted the top 1 percent to loot $54 trillion from the bottom 90 percent, from 1975 to 2022, at a rate of $2.5 trillion a year, according to a study by the RAND corporation.” For those who don’t know, RAND is a despicably Satanic corporation that spends most of its time on planning wars, designing torture regimes (Vietnam Phoenix, Guantanamo Bay, Baghram, Diego Garcia), and scheming for world political control. But the people at RAND do know how to calculate, especially considering they planned the methods for the looting they now boast about. Note that the euphemistically-named “top 1%” is not really the top 1% but a tiny group of Jewish bankers and industrialists, including the (Rothschild and other) owners of the US FED. A huge portion of this looting occurred in 2008 and subsequent years; I won’t bother accumulating this with interest.

不仅仅是房屋,也不仅仅是2008年。在一篇名为《美国民主的破坏者》的文章中

,克里斯·赫奇斯(Chris Hedges)引用兰德公司的一份报告称: “根据兰德公司的一项研究,这些建制派政客和他们任命的法官颁布的法律,允许最富有的1%从最贫穷的90%那里掠夺54万亿美元,从1975年到2022年,每年的速度为2.5万亿美元。” 有些人可能不了解兰德,兰德公司是一个卑鄙的撒旦公司,把大部分时间花在策划战争,设计酷刑制度(越南凤凰城,关塔那摩湾,巴格兰姆,迪戈加西亚),并策划世界政治控制。但兰德公司的人确实知道如何计算,特别是考虑到他们为现在吹嘘的抢劫计划了方法。请注意,被委婉地命名为“最富有的1%”并不是真正的最富有的1%,而是一小群犹太银行家和实业家,包括美国美联储的(罗斯柴尔德和其他)所有者。这种抢劫的很大一部分发生在2008年及随后的几年。我就不费事加利息了。

记账:54万亿美元

(11) The Great Gold Robbery – Part I – The US FED

In the early years after the creation of the Rothschild-owned FED, the US was still on a gold standard for its currency; new money could be issued by the FED only if it had at least 40% of that amount in gold. But, as the Jewish bankers have always done in every country, they issued paper currency far beyond the permitted limits, which was the prime cause of the 1929 Great Depression. By 1933, the FED had only about 6,000 metric tons of gold in its vaults, and was about 50,000 tonnes short for the paper currency it had issued. The public were aware generally of what was happening and, with concerns of US paper money becoming worthless, were spending the paper and hoarding the gold coins and bars, while small banks and companies were hoarding gold bullion. There was no way out of this trap. The FED needed a huge infusion of gold to prevent a collapse of the currency, but its owners had no intention of investing their own money to prevent the financial collapse of America. Their solution was to convince Roosevelt and Congress that the real problem was citizens preventing the economy from naturally prospering, by holding gold. On their advice, Roosevelt passed the famous 1602 provision which confiscated all the privately-held gold (in all forms) in the US, all citizens forced to turn over their gold to the FED, under penalty of a $10,000 fine plus a 10-year prison sentence. Note that the gold was not surrendered to the US Treasury Department, but to the privately-owned FED.

11. 黄金大劫案,第一部分,美国联邦储备委员会

罗斯柴尔德旗下的美联储成立后的最初几年,美国仍在实行金本位制。美联储发行新货币的前提是至少有40%是黄金。但是,就像每个国家的犹太银行家总是做的那样,他们发行的纸币远远超过了允许的限额,这是1929年大萧条的主要原因。到1933年,美联储的金库里只有大约6000吨黄金,与它发行的纸币还差约5万吨。公众普遍意识到正在发生的事情,由于担心美国纸币变得一文不值,他们在消费纸币,囤积金币和金条,而小银行和公司则在囤积金条。这个陷阱是没有出路的。美联储需要大量的黄金注入,以防止货币崩溃,但它的所有者并不打算投资自己的钱来防止美国的金融崩溃。他们的解决方案是说服罗斯福和国会,真正的问题是公民通过持有黄金阻止了经济的自然繁荣。在他们的建议下,罗斯福通过了著名的1602条款,没收了美国所有私人持有的黄金(各种形式),所有公民被迫将他们的黄金交给美联储,罚款1万美元,并处10年监禁。请注意,这些黄金并没有交给美国财政部,而是交给了私营的美联储。

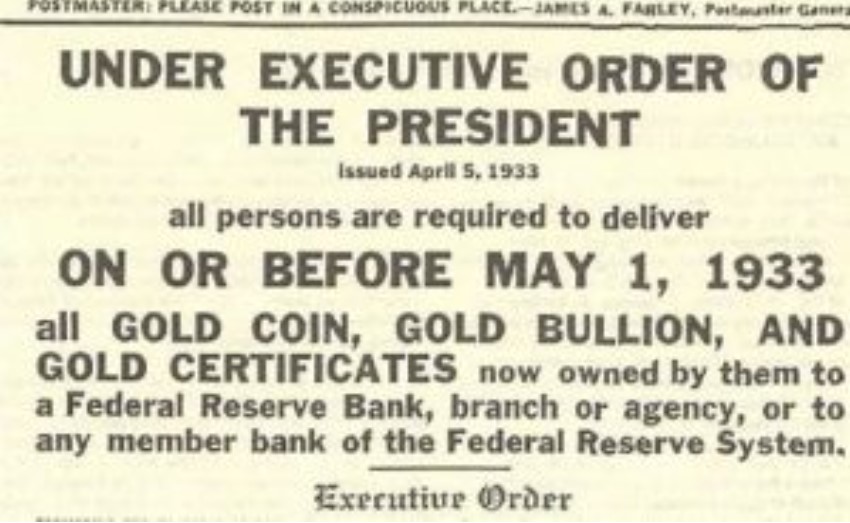

图:《总统行政令》——1933年4月5日 所有人必须在1933年5月1日及之前,将所有金币,金条和黄金证明交予联邦储备银行、分支或机构、或任何联邦储备体系加盟银行。

评论翻译

(未完待续)

很赞 ( 0 )

收藏