瑞幸咖啡的挑战者将中国咖啡价格战推向沸点

瑞幸咖啡的挑战者将中国咖啡价格战推向沸点

Luckin challenger pushes China’s coffee price war towards boiling point

译文简介

库迪咖啡似乎正在尽力维持其快速扩张势头,因为它已经面临着特许经营商的运营问题,并且在瑞幸咖啡的反击下遭受了大量店铺的关闭。当两家咖啡连锁店在廉价市场展开较量时,中国最大的国际咖啡公司星巴克正专注于在中国的小城市站稳脚跟。

正文翻译

题图:瑞幸和库迪的宣传海报显示其均提供9.90元咖啡。

China’s coffee market is in the midst of a price war, and it is showing no sign of abating as the country’s leading affordable brand Luckin Coffee Inc. faces down challenger Cotti Coffee, the upstart launched by Luckin’s disgraced co-founders Lu Zhengyao and Qian Zhiya.

中国的咖啡市场正处于价格战的漩涡之中,随着中国领先的平价品牌瑞幸咖啡击败挑战者库迪咖啡,价格战也没有减弱的迹象。库迪咖啡是瑞幸咖啡名誉扫地的联合创始人陆正耀和钱治亚新创立的。

中国的咖啡市场正处于价格战的漩涡之中,随着中国领先的平价品牌瑞幸咖啡击败挑战者库迪咖啡,价格战也没有减弱的迹象。库迪咖啡是瑞幸咖啡名誉扫地的联合创始人陆正耀和钱治亚新创立的。

Forced out of Luckin for their role in perpetrating a US$300 million fraud, Lu and Qian returned in late 2022 with a new venture and promptly went to battle with their former brainchild. They adopted the same low-price strategy, at one point undercutting Luckin’s best discount.

陆正耀和钱治亚因参与3亿美元的诈骗案而被勒令退出瑞幸,2022年底,他们带着一家新企业又回到了瑞幸所在的咖啡市场,并迅速与他们的前公司展开了较量。他们同样采取了低价策略,一度也压低了瑞幸的最佳折扣。

陆正耀和钱治亚因参与3亿美元的诈骗案而被勒令退出瑞幸,2022年底,他们带着一家新企业又回到了瑞幸所在的咖啡市场,并迅速与他们的前公司展开了较量。他们同样采取了低价策略,一度也压低了瑞幸的最佳折扣。

But Cotti — named after the Italian biscuit biscotti — appears to be struggling to sustain its rapid expansion, having already faced operational issues with franchisees and suffering a spate of store closures, as Luckin fights back.

但是,在瑞幸的反击下,以意大利饼干命名的库迪似乎正在尽力维持其快速扩张势头,因其已经面临加盟商的运营问题和一系列关店事件。

但是,在瑞幸的反击下,以意大利饼干命名的库迪似乎正在尽力维持其快速扩张势头,因其已经面临加盟商的运营问题和一系列关店事件。

Meanwhile, as the two Chinese brands duke it out at the cheap end of the market, China’s largest international player, Starbucks Corp., which offers brews at comparatively premium prices, is distancing itself from the competition and focusing instead on growing its foothold in the country’s smaller cities.

与此同时,随着这两个品牌在廉价市场上大打出手,中国最大的国际咖啡品牌星巴克正在远离竞争,转而专注于在中国小城市站稳脚跟。

与此同时,随着这两个品牌在廉价市场上大打出手,中国最大的国际咖啡品牌星巴克正在远离竞争,转而专注于在中国小城市站稳脚跟。

This divergence in strategies is being seen as coffee brands of all sizes vie for a bigger share of China’s fast-growing market. The Asian nation has overtaken the US as the world’s largest branded coffee shop market by number of outlets, expanding 58% over the last year to nearly 50,000 locations, according to a report published in December by industry media World Coffee Portal.

各种规模的咖啡品牌都在争夺中国快速增长市场的更多份额,因此出现了战略上的分歧。据行业媒体“世界咖啡门户”于12月发布的一份报告称,按门店数量计算,中国已超过美国成为世界上最大的品牌咖啡店市场,去年增长了58%,门店数量接近50000家。

各种规模的咖啡品牌都在争夺中国快速增长市场的更多份额,因此出现了战略上的分歧。据行业媒体“世界咖啡门户”于12月发布的一份报告称,按门店数量计算,中国已超过美国成为世界上最大的品牌咖啡店市场,去年增长了58%,门店数量接近50000家。

With xiamen-based Luckin beginning to scale back its offers recently and Beijing-based Cotti kicking off new promotions despite many of its stores facing a raft of problems, the direction of the price war and the coffee market landscape are in flux.

最近,总部位于厦门的瑞幸咖啡开始缩减优惠力度,而总部位于北京的库迪咖啡在其许多门店面临一系列问题的情况下仍启动了新的促销活动,价格战的走向和咖啡市场的格局正在发生变化。

原创翻译:龙腾网 https://www.ltaaa.cn 转载请注明出处

最近,总部位于厦门的瑞幸咖啡开始缩减优惠力度,而总部位于北京的库迪咖啡在其许多门店面临一系列问题的情况下仍启动了新的促销活动,价格战的走向和咖啡市场的格局正在发生变化。

原创翻译:龙腾网 https://www.ltaaa.cn 转载请注明出处

“Growth was led by the rapid expansion of small store format and delivery focused Luckin Coffee and Cotti Coffee,” the report said. Starbucks, which once reigned supreme in China, now ranks as the second largest branded coffee operator in the country by outlets, the report added.

报告称:“小型门店的快速扩张和以外卖为主的瑞幸和库迪咖啡带动了增长。”报告补充说,星巴克曾一度在中国称王称霸,现在按门店数计算,只是中国第二大品牌咖啡运营商。

报告称:“小型门店的快速扩张和以外卖为主的瑞幸和库迪咖啡带动了增长。”报告补充说,星巴克曾一度在中国称王称霸,现在按门店数计算,只是中国第二大品牌咖啡运营商。

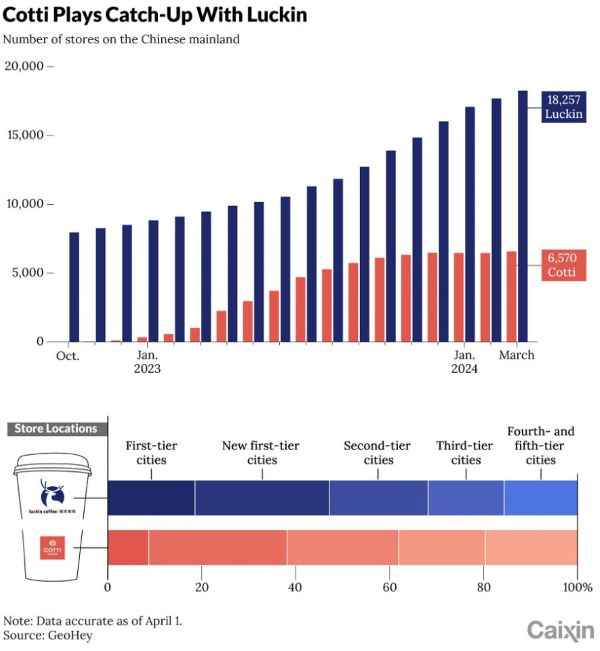

插图:瑞幸和库迪的年度店铺数量和一到五线城市分布情况。

As of early March, Luckin had opened over 17,800 stores in China — significantly outstripping Starbucks’ 7,770 locations and Cotti’s close to 6,800, according to food and beverage industry information provider Canyan Data.

食品饮料行业信息提供商Canyan Data的数据显示,截至3月初,瑞幸已在中国开设了17800多家门店,大大超过了星巴克的7770家和库迪的近6800家。

食品饮料行业信息提供商Canyan Data的数据显示,截至3月初,瑞幸已在中国开设了17800多家门店,大大超过了星巴克的7770家和库迪的近6800家。

The rise of Luckin reflects a broader trend among Chinese consumers who increasingly favour cheaper products amid low confidence and a sluggish economy. However, a more-than year-long struggle with Cotti has taken a toll on Luckin’s expansion momentum and bottom line, as the company booked a drop in its profitability in the fourth quarter of 2023.

瑞幸的崛起反映了在信心不足和经济低迷的背景下,中国消费者越来越青睐廉价产品的大趋势。然而,与库迪长达一年多的斗争已对瑞幸的扩张势头和底线造成了影响,因为该公司在2023年第四季度的利润率有所下降。

瑞幸的崛起反映了在信心不足和经济低迷的背景下,中国消费者越来越青睐廉价产品的大趋势。然而,与库迪长达一年多的斗争已对瑞幸的扩张势头和底线造成了影响,因为该公司在2023年第四季度的利润率有所下降。

Cotti challenges Luckin

库迪挑战瑞幸

库迪挑战瑞幸

Luckin’s co-founders Qian and Lu made their comeback in the coffee industry in October 2022, founding Cotti with a more aggressive franchise model that eschewed traditional franchise fees in favour of an approach that allows the company to share profits and risk with its franchisees.

2022年10月,瑞幸的联合创始人钱和陆在咖啡行业卷土重来,他们创立了库迪咖啡,采用了更为激进的特许经营模式,放弃了传统的特许经营费,转而与加盟商分享利润和分担风险。

2022年10月,瑞幸的联合创始人钱和陆在咖啡行业卷土重来,他们创立了库迪咖啡,采用了更为激进的特许经营模式,放弃了传统的特许经营费,转而与加盟商分享利润和分担风险。

But the pair used the low-price, subsidy-driven strategy that they had employed to fuel Luckin’s rapid rise. In February 2023, the newcomer launched a promotion that offered coffee for as low as 9.90 RMB (US$1.37) per cup. Soon after, it launched a weekly 8.80-RMB promotion and a limited-time 1-RMB discount for new customers.

但这对搭档沿用了曾为瑞幸的迅速崛起推波助澜的低价补贴驱动策略。2023年2月,这家新公司推出了促销活动,每杯咖啡的价格低至9.90元人民币(1.37美元)。不久后,它又推出了每周8.80元的促销活动,以及针对新顾客的限时1元折扣。

但这对搭档沿用了曾为瑞幸的迅速崛起推波助澜的低价补贴驱动策略。2023年2月,这家新公司推出了促销活动,每杯咖啡的价格低至9.90元人民币(1.37美元)。不久后,它又推出了每周8.80元的促销活动,以及针对新顾客的限时1元折扣。

The chain is still in a phase of breakneck expansion as it tries to grab market share. To this end, the headquarters is subsidising its franchisees to ensure their stores are profitable, chief strategy officer Li Yingbo told Caixin, adding that this subsidy policy will last until the end of this year.

库迪的连锁店仍处于快速扩张阶段,试图抢占市场份额。首席策略官李颖波告诉财新记者,总部为此正在对加盟商进行补贴,以确保他们的门店盈利,并说这一补贴政策将持续到今年年底。

库迪的连锁店仍处于快速扩张阶段,试图抢占市场份额。首席策略官李颖波告诉财新记者,总部为此正在对加盟商进行补贴,以确保他们的门店盈利,并说这一补贴政策将持续到今年年底。

Not to be outdone, Luckin launched a weekly 9.90-RMB coupon campaign in June 2023. Two months later, its CEO announced that the campaign would be extended for at least two more years.

瑞幸也不甘示弱,于2023年6月推出了每周9.9元的优惠券活动。两个月后,其首席执行官宣布该活动将至少再延长两年。

原创翻译:龙腾网 https://www.ltaaa.cn 转载请注明出处

瑞幸也不甘示弱,于2023年6月推出了每周9.9元的优惠券活动。两个月后,其首席执行官宣布该活动将至少再延长两年。

原创翻译:龙腾网 https://www.ltaaa.cn 转载请注明出处

The decision came at a time when Luckin desperately needed to stabilise its market position, after it opened its 10,000th store in China in June, becoming the first coffee chain in the country to reach that threshold, a company executive told Caixin.

一位公司高管告诉财新记者,这一决定的做出正值瑞幸急需稳定其市场地位之际,因为它在今年6月在中国开设了第10000家门店,成为中国第一家达到这一门槛的咖啡连锁店。

一位公司高管告诉财新记者,这一决定的做出正值瑞幸急需稳定其市场地位之际,因为它在今年6月在中国开设了第10000家门店,成为中国第一家达到这一门槛的咖啡连锁店。

While Cotti has fewer stores than Luckin, the former reaches more cities.

虽然库迪的门店数量少于瑞幸,但前者覆盖的城市更多。

虽然库迪的门店数量少于瑞幸,但前者覆盖的城市更多。

插图:北京的一家库迪咖啡店铺中的员工们正在准备饮料。

Cotti has expanded its footprint to more than 330 of the country’s nearly 400 county-level cities, Li said. As of Monday, Cotti already had 80 stores in xinjiang and ten in neighbouring xizang, while Luckin has yet to enter either of the two autonomous regions, according to GeoHey, a Beijing-based company that tracks the locations of more than 1,000 chain brands nationwide.

李颖波说,在全国近400个县级城市中,库迪的足迹已扩展到330多个。总部位于北京的GeoHey是一家追踪全国1000多个连锁品牌位置的公司,该公司的数据显示,截至本周一,库迪已在新疆拥有80家门店,在邻近的西藏拥有10家门店,而瑞幸尚未进入这两个自治区。

原创翻译:龙腾网 https://www.ltaaa.cn 转载请注明出处

李颖波说,在全国近400个县级城市中,库迪的足迹已扩展到330多个。总部位于北京的GeoHey是一家追踪全国1000多个连锁品牌位置的公司,该公司的数据显示,截至本周一,库迪已在新疆拥有80家门店,在邻近的西藏拥有10家门店,而瑞幸尚未进入这两个自治区。

原创翻译:龙腾网 https://www.ltaaa.cn 转载请注明出处

Cotti could not have kept up the pace of its expansion had it not been for its initial efforts to aggressively attract franchisees, including offering a number of incentives, a coffee industry analyst told Caixin. In addition, Luckin has restrictions on franchise partners’ age, assets and how they work together, while Cotti has none of those requirements, he said. “Many of Cotti’s franchise partners were those rejected by Luckin.”

一位咖啡行业分析师告诉财新记者,如果不是库迪最初努力积极吸引加盟商,包括提供一系列激励措施,它不可能跟上扩张的步伐。他说,此外,瑞幸对加盟伙伴的年龄、资产和合作方式都有限制,而库迪则没有这些要求。“库迪的许多特许经营合作伙伴都是那些被瑞幸拒绝过的人”。

一位咖啡行业分析师告诉财新记者,如果不是库迪最初努力积极吸引加盟商,包括提供一系列激励措施,它不可能跟上扩张的步伐。他说,此外,瑞幸对加盟伙伴的年龄、资产和合作方式都有限制,而库迪则没有这些要求。“库迪的许多特许经营合作伙伴都是那些被瑞幸拒绝过的人”。

Cotti has also taken to locating its stores tactically. One franchisee told Caixin that by choosing a location next to a Luckin store, franchisees are more likely to pass the vetting process by headquarters staff, who believe that Luckin’s reputation will bring them more customer traffic.

库迪还采取了战术性的门店选址。一位加盟商告诉财新记者,通过选址在瑞幸门店旁边,加盟商更有可能通过总部员工的审核,他们认为瑞幸的声誉会给他们带来更多客流。

库迪还采取了战术性的门店选址。一位加盟商告诉财新记者,通过选址在瑞幸门店旁边,加盟商更有可能通过总部员工的审核,他们认为瑞幸的声誉会给他们带来更多客流。

While Li stopped short of revealing Cotti’s financing information, a company source said that the coffee chain had benefited from government preferential policies and has its own capital.

虽然李颖波没有透露库迪的融资信息,但该公司的一位消息人士称,这家咖啡连锁店受益于政府的优惠政策,并且拥有自有资本。

虽然李颖波没有透露库迪的融资信息,但该公司的一位消息人士称,这家咖啡连锁店受益于政府的优惠政策,并且拥有自有资本。

Luckin counterattacks

瑞幸的反击

瑞幸的反击

Cotti’s tactics worked well initially, with many of its partners tasting success. Wang Zhensheng, a franchisee with 20 Cotti stores in Linyi, East China’s Shandong province, told Caixin that his average daily sales per store in the first half of 2023 ranged from 350 to 450 cups, with a monthly net profit of between 30,000 RMB and 40,000 RMB.

库迪的策略在初期效果不错,许多合作伙伴都尝到了成功的甜头。在山东临沂拥有20家库迪门店的加盟商王振生告诉财新记者,2023年上半年,他的每家门店日均销售额在350杯到450杯之间,月净利润在3万元到4万元之间。

库迪的策略在初期效果不错,许多合作伙伴都尝到了成功的甜头。在山东临沂拥有20家库迪门店的加盟商王振生告诉财新记者,2023年上半年,他的每家门店日均销售额在350杯到450杯之间,月净利润在3万元到4万元之间。

However, things changed as Luckin reacted and diversified its franchise business. In May, the company launched a new franchise model that encourages existing shop operators in more than 100 cities to become its partners. The coffee chain then experienced a marked expansion, opening more than 5,800 new stores from July through December, more than double the 2,244 shops in the first half of 2023 and a staggering 280% increase on openings in the second half of 2022, GeoHey data show.

然而,随着瑞幸做出反应,并将其特许经营业务多元化,情况发生了变化。今年5月,该公司推出了一种新的特许经营模式,鼓励100多个城市的现有店铺经营者成为其合作伙伴。GeoHey的数据显示,瑞幸咖啡连锁店随后经历了明显的扩张,从7月到12月新开了5800多家店,是2023 年上半年2244家店的两倍多,比2022年下半年的开店数量增长了280%。

然而,随着瑞幸做出反应,并将其特许经营业务多元化,情况发生了变化。今年5月,该公司推出了一种新的特许经营模式,鼓励100多个城市的现有店铺经营者成为其合作伙伴。GeoHey的数据显示,瑞幸咖啡连锁店随后经历了明显的扩张,从7月到12月新开了5800多家店,是2023 年上半年2244家店的两倍多,比2022年下半年的开店数量增长了280%。

The surge in Luckin shops has disrupted Cotti’s plans. Several Cotti franchisees from different regions said their monthly profit per store has dropped to around 10,000 RMB in recent months.

瑞幸店铺的激增打乱了库迪的计划。来自不同地区的几家库迪加盟商表示,最近几个月,他们每家店的月利润已降至1万元人民币左右。

瑞幸店铺的激增打乱了库迪的计划。来自不同地区的几家库迪加盟商表示,最近几个月,他们每家店的月利润已降至1万元人民币左右。

“The data we monitored shows that about 20% to 30% of Cotti’s franchisees are profitable, about 20% to 30% break even, and the rest are losing money,” an investor told Caixin. “Cotti has already closed more than 1,000 stores.”

“我们监测到的数据显示,库迪约有20%至30%的加盟店盈利,约20%至30%的加盟店收支平衡,其余的都在亏损。”一位投资者告诉财新记者,“库迪已经关闭了1000多家门店。”

“我们监测到的数据显示,库迪约有20%至30%的加盟店盈利,约20%至30%的加盟店收支平衡,其余的都在亏损。”一位投资者告诉财新记者,“库迪已经关闭了1000多家门店。”

These closures have cast a shadow over the future of Cotti, which relies heavily on the franchise model. One Cotti employee told Caixin that many of his colleagues are now pessimistic about the company’s growth prospects because “many franchisees have reached the end of their patience”.

这些门店的关闭给严重依赖特许经营模式的库迪的未来蒙上了一层阴影。一位库迪员工告诉财新记者,他的许多同事现在对公司的发展前景感到悲观,因为“许多加盟商已经忍无可忍”。

这些门店的关闭给严重依赖特许经营模式的库迪的未来蒙上了一层阴影。一位库迪员工告诉财新记者,他的许多同事现在对公司的发展前景感到悲观,因为“许多加盟商已经忍无可忍”。

He predicted that if Cotti is not able to launch a blockbuster product soon, a more severe wave of store closures could hit before the year is out.

他预计,如果库迪无法尽快推出大卖产品,那么在今年年底之前,可能会出现更严重的关店潮。

他预计,如果库迪无法尽快推出大卖产品,那么在今年年底之前,可能会出现更严重的关店潮。

“The picture is very clear now,” said one Luckin investor — it will be hard to find another team in the market that can outperform Luckin, she said, adding that the dominant player still has the potential to double its store count in lower-tier cities.

一位瑞幸的投资者说:“现在的情形已经很清楚了,”她说,在市场上很难再找到一个能超越瑞幸的团队,并说,这家主导企业仍有潜力将其在低线城市的门店数量翻一番。

一位瑞幸的投资者说:“现在的情形已经很清楚了,”她说,在市场上很难再找到一个能超越瑞幸的团队,并说,这家主导企业仍有潜力将其在低线城市的门店数量翻一番。

Meanwhile, well-known venture capitalists and private equity funds are generally wary of investments related to Luckin’s founding team due to their integrity issues, a coffee industry consultant told Caixin. Some investors are willing to “secretly” back Cotti because they trust Lu, but more are shunning the startup, the consultant said.

一位咖啡行业顾问告诉财新记者,与此同时,由于瑞幸创始团队的诚信问题,知名风投和私募股权基金普遍对其相关投资持谨慎态度。这位顾问说,一些投资者因为信任陆兆禧而愿意“暗中”支持库迪,但更多的投资者则在回避这家初创企业。

一位咖啡行业顾问告诉财新记者,与此同时,由于瑞幸创始团队的诚信问题,知名风投和私募股权基金普遍对其相关投资持谨慎态度。这位顾问说,一些投资者因为信任陆兆禧而愿意“暗中”支持库迪,但更多的投资者则在回避这家初创企业。

插图:2023年3月31日开业的新加坡瑞幸咖啡滨海广场店前排了长队。

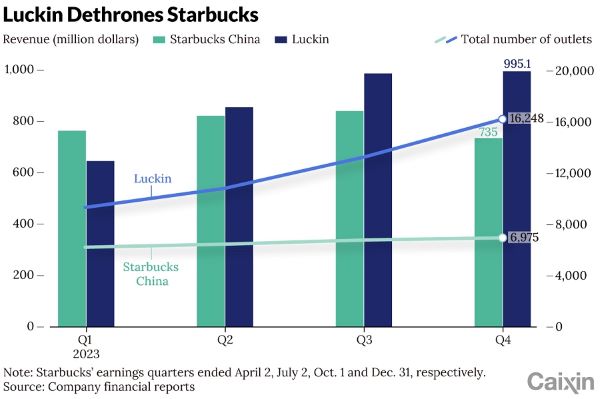

Luckin generated net revenue of 7 billion RMB in the fourth quarter of 2023, up 91.2% on the year, according to its annual financial report published in February. For the whole year, it turned over 24.9 billion RMB, or US$3.44 billion, of net revenue, up 87.3% from 2022, surpassing Starbucks’ comparable annual sales of US$3.16 billion in China to become the country’s biggest coffee chain. Luckin’s sales include those from its small overseas operations including Singapore.

根据今年2月发布的年度财务报告,瑞幸2023年第四季度实现净营收70亿元人民币,同比增长91.2%。全年实现净收入249亿元人民币,约合34.4亿美元,比2022年增长87.3%,超过星巴克在中国31.6亿美元的可比年销售额,成为中国最大的咖啡连锁店。瑞幸的销售额包括了其新加坡等小型海外业务的销售额。

根据今年2月发布的年度财务报告,瑞幸2023年第四季度实现净营收70亿元人民币,同比增长91.2%。全年实现净收入249亿元人民币,约合34.4亿美元,比2022年增长87.3%,超过星巴克在中国31.6亿美元的可比年销售额,成为中国最大的咖啡连锁店。瑞幸的销售额包括了其新加坡等小型海外业务的销售额。

However, the price war did hurt Luckin’s profit margins. “Our reported overall operating margin in the fourth quarter of 2023 was 3%, compared to 8.5% in the same period (of 2022),” chief financial officer An Jing said on an earnings call in February.

然而,价格战确实损害了瑞幸的利润率。首席财务官安静在今年2月的一次财报电话会议上说:“我们2023年第四季度报告的整体营业利润率为3%,而2022 年同期为8.5%。”

然而,价格战确实损害了瑞幸的利润率。首席财务官安静在今年2月的一次财报电话会议上说:“我们2023年第四季度报告的整体营业利润率为3%,而2022 年同期为8.5%。”

The drop was “mainly driven by the decrease in average selling price as we continued our ‘10,000th store celebration event’ campaign as well as the weak traffic in the winter season,” An said.

安静在2月份的财报电话会议上说:“营业利润率下降的主要原因是,由于我们继续开展'第10000家门店庆祝活动',平均售价有所下降,而且冬季客流量疲软。”

安静在2月份的财报电话会议上说:“营业利润率下降的主要原因是,由于我们继续开展'第10000家门店庆祝活动',平均售价有所下降,而且冬季客流量疲软。”

Luckin’s supporters expect the chain’s operating margins will rebound as Cotti keeps closing stores.

瑞幸的支持者预计,随着库迪不断关闭门店,连锁店的营业利润率将出现反弹。

瑞幸的支持者预计,随着库迪不断关闭门店,连锁店的营业利润率将出现反弹。

Some industry insiders are worried that the price war will end in a lose-lose situation. Cotti partner Wang told Caixin that if it continues this year, he expects both Cotti and Luckin will have trouble surviving.

一些业内人士担心,价格战将以两败俱伤告终。库迪的一位王姓合伙人告诉财新记者,如果价格战持续到今年,他预计库迪和瑞幸都将难以生存。

一些业内人士担心,价格战将以两败俱伤告终。库迪的一位王姓合伙人告诉财新记者,如果价格战持续到今年,他预计库迪和瑞幸都将难以生存。

But Cotti appears to have no intention of pulling out of the price war, announcing a new three-month 9.90-RMB unlimited offer on 26 February. Luckin, however, recently reduced the variety of drinks that can be bought with the 9.90-RMB coupon on its app.

但库迪似乎无意退出价格战,它在2月26日宣布了新的三个月9.9元不限量优惠活动。然而,瑞幸最近减少了其应用程序上可用9.9元优惠券购买的饮品种类。

但库迪似乎无意退出价格战,它在2月26日宣布了新的三个月9.9元不限量优惠活动。然而,瑞幸最近减少了其应用程序上可用9.9元优惠券购买的饮品种类。

Starbucks’ expansion

星巴克的扩张

星巴克的扩张

Despite the tens of thousands of stores and 1,000-plus chains operating in China, the country’s coffee market is still budding and not yet fully tiered, said Belinda Wong, chair and co-CEO of Starbucks China, during an earnings call in January. Wong believes that the current situation, where many competitors are focusing on “fast store expansion and low-price tactics” will “shake out over time”.

星巴克中国董事长兼联席首席执行官王静瑛在今年1月的财报电话会议上表示,尽管在中国有数万家门店和1000多家连锁店,但中国的咖啡市场仍处于萌芽阶段,尚未完全分级。王静瑛认为,目前许多竞争对手都在专注于“快速扩张门店和低价策略”,但这种情况也会“随着时间的推移而改变”。

原创翻译:龙腾网 https://www.ltaaa.cn 转载请注明出处

星巴克中国董事长兼联席首席执行官王静瑛在今年1月的财报电话会议上表示,尽管在中国有数万家门店和1000多家连锁店,但中国的咖啡市场仍处于萌芽阶段,尚未完全分级。王静瑛认为,目前许多竞争对手都在专注于“快速扩张门店和低价策略”,但这种情况也会“随着时间的推移而改变”。

原创翻译:龙腾网 https://www.ltaaa.cn 转载请注明出处

“We are not interested in entering the price war,” Wong said. “We are focusing on capturing high quality but profitable, sustainable growth.”

“我们对参与价格战不感兴趣,”王说。“我们的重点是抓住高质量但有利可图的可持续增长”。

“我们对参与价格战不感兴趣,”王说。“我们的重点是抓住高质量但有利可图的可持续增长”。

During the call, Wong also announced that the company would expand into new county-level cities. The opportunities are abundant, she said, citing figures that Starbucks had entered only 857 of China’s nearly 3,000 cities at or above the county level as of the end of December.

在电话会议上,王还宣布公司将向新的县级城市扩张。她援引数据说,截至12月底,在中国近3000个县级以上城市中,星巴克只进入了857个。

在电话会议上,王还宣布公司将向新的县级城市扩张。她援引数据说,截至12月底,在中国近3000个县级以上城市中,星巴克只进入了857个。

插图:星巴克和瑞幸的2023年四季度国内收入情况比较。

Starbucks founder Howard Schultz echoed Wong’s sentiment at a forum in Shanghai last month. The US firm, which entered the Chinese mainland in 1999, must “recognise that competition is happening”, said Schultz, but “I’m not spending one minute of my time worrying about it” and will strictly focus on the business itself.

星巴克创始人霍华德-舒尔茨上个月在上海的一次论坛上也表达了同样的观点。舒尔茨说,这家1999年进入中国大陆的美国公司必须“认识到竞争正在发生”,但“我不会花一分一秒的时间去担心这个问题”,而会严格专注于业务本身。

星巴克创始人霍华德-舒尔茨上个月在上海的一次论坛上也表达了同样的观点。舒尔茨说,这家1999年进入中国大陆的美国公司必须“认识到竞争正在发生”,但“我不会花一分一秒的时间去担心这个问题”,而会严格专注于业务本身。

Acknowledging that customer preferences are changing, Schultz, former CEO of the company, said “we will adjust our strategy accordingly,” but the adjustments will not be “dramatic”.

该公司前首席执行官舒尔茨承认顾客的偏好正在发生变化,他说:“我们将相应地调整我们的战略”,但调整不会很“剧烈”。

该公司前首席执行官舒尔茨承认顾客的偏好正在发生变化,他说:“我们将相应地调整我们的战略”,但调整不会很“剧烈”。

Customers will upgrade their preferences from low-end and discount coffee over time, so what Starbucks needs to do is “continue to earn the respect of the marketplace,” he said.

他说,随着时间的推移,顾客会从低端咖啡和折扣咖啡中提升自己的喜好,因此星巴克需要做的就是“继续赢得市场的尊重”。

他说,随着时间的推移,顾客会从低端咖啡和折扣咖啡中提升自己的喜好,因此星巴克需要做的就是“继续赢得市场的尊重”。

The US giant’s expansion into smaller cities comes as it is looking for new growth points in China. Its China strategy had long been centred on the first-tier market, offering relatively expensive coffee and expanding mainly into big cities as it tapped the middle class and businesspeople. About 66% of its stores are in the mainland’s first-tier cities of Beijing, Shanghai, Guangzhou and Shenzhen and so-called new first-tier cities such as Hangzhou, Chengdu and Suzhou, according to GeoHey’s data.

这家美国巨头向小城市扩张的同时,也在中国寻找着新的增长点。长期以来,它的中国战略一直以一线市场为中心,提供相对昂贵的咖啡,并主要向大城市扩张,以吸引中产阶级和商务人士。根据GeoHey的数据,其约66%的门店位于北京、上海、广州和深圳等内地一线城市,以及杭州、成都和苏州等所谓的新一线城市。

这家美国巨头向小城市扩张的同时,也在中国寻找着新的增长点。长期以来,它的中国战略一直以一线市场为中心,提供相对昂贵的咖啡,并主要向大城市扩张,以吸引中产阶级和商务人士。根据GeoHey的数据,其约66%的门店位于北京、上海、广州和深圳等内地一线城市,以及杭州、成都和苏州等所谓的新一线城市。

However, many consumers have tightened their belts following the pandemic, as a weak economy, real estate slump and high unemployment rattle confidence. All of these factors drove the premium brand to revamp its strategy.

然而,由于经济疲软、房地产不景气和失业率居高不下,许多消费者在疫情发生后勒紧了裤腰带,信心受挫。所有这些因素都促使这个高端品牌重整战略。

然而,由于经济疲软、房地产不景气和失业率居高不下,许多消费者在疫情发生后勒紧了裤腰带,信心受挫。所有这些因素都促使这个高端品牌重整战略。

A source close to Starbucks told Caixin that the opening of the first store of a brand like Starbucks in a lower-tier city usually ushers in a large amount of traffic, as local coffee drinkers see this as an upgrade.

一位接近星巴克的人士告诉财新记者,像星巴克这样的品牌在小城市开设第一家门店通常会带来大量客流,因为当地的咖啡饮者认为这是一种消费升级。

原创翻译:龙腾网 https://www.ltaaa.cn 转载请注明出处

一位接近星巴克的人士告诉财新记者,像星巴克这样的品牌在小城市开设第一家门店通常会带来大量客流,因为当地的咖啡饮者认为这是一种消费升级。

原创翻译:龙腾网 https://www.ltaaa.cn 转载请注明出处

插图:中国北京一家星巴克咖啡连锁店外国旗飘扬。

But some industry insiders are concerned that Starbucks may not be able to sustain growth in smaller cities after the initial boom fades.

但一些业内人士担心,在最初的热潮退去后,星巴克可能无法维持在小城市的增长。

但一些业内人士担心,在最初的热潮退去后,星巴克可能无法维持在小城市的增长。

One caterer from a lower-tier city told Caixin that demand for coffee in their area has been insufficient recently, and as a result they are considering expanding into the milk tea business.

一位来自较低线城市的餐饮业者告诉财新记者,他们所在地区最近对咖啡的需求不足,因此正在考虑拓展奶茶业务。

一位来自较低线城市的餐饮业者告诉财新记者,他们所在地区最近对咖啡的需求不足,因此正在考虑拓展奶茶业务。

A coffee equipment franchisee in Chongqing echoed this sentiment. “Many stores have closed down within a year of opening,” the person said. “Demand for coffee in lower-tier markets is actually not that high.”

重庆一位咖啡设备加盟商也有同感。该人士说:“很多门店开业不到一年就倒闭了。低线市场对咖啡的需求其实并不高。”

重庆一位咖啡设备加盟商也有同感。该人士说:“很多门店开业不到一年就倒闭了。低线市场对咖啡的需求其实并不高。”

评论翻译

暂无评论。

很赞 ( 8 )

收藏