这 3 张图表显示了 2023 年金融科技的顶级国家,显示中国正在追赶美国

这 3 张图表显示了 2023 年金融科技的顶级国家,显示中国正在追赶美国

With China playing catchup with the U.S., these 3 charts show the top countries for fintech in 2023

译文简介

不同国家金融科技公司数量和实力的比较

正文翻译

From the U.S. to China, countries around the world are battling it out to lead on financial technology, a heavily lucrative industry that has grown over the years taking everything from retail banking to wealth management online.

从美国到中国,世界各国正在争夺引领金融技术的领先位置,这是一个利润丰厚的行业,从零售银行到在线财富管理,多年来一直在发展壮大。

Since the 2008 financial crisis, thousands of new firms have been set up with the aim of taking on the financial incumbents and providing more accessible services to both consumers and businesses alike.

自2008年金融危机以来,数千家新公司成立立志取代现在的金融机构,为消费者和企业提供更便捷的服务。

In the U.K., startups like Monzo and Starling took the banking world by storm with their digital-only offerings, while in China, Alibaba and Tencent launched their own respective mobile wallets, Alipay and WeChat Pay.

在英国,Monzo和Starling等初创公司通过仅提供数字产品突袭了银行界,而在中国,阿里巴巴和腾讯推出了各自的移动钱包支付宝和微信支付。

In August, CNBC, in partnership with Statista, launched a list of the world’s top fintechs. To choose the top global firms, Statista used a rigorous method that uated a few key business metrics and fundamentals, including revenue and number of employees.

8月,美国消费者新闻与商业频道(CNBC)与Statista合作,推出了一份世界顶级金融科技公司名单。为了选择全球顶级公司,Statista使用了一种严格的方法,评估了一些关键的业务指标和基本面,包括收入和员工人数。

Statista identified 200 of the top companies globally, across nine categories including neobanking, digital payments, digital assets, digital financial planning, digital wealth management, alternate financing, alternate lending, digital banking solutions, and digital business solutions.

Statista确定了全球200家顶级公司,涵盖新银行、数字支付、数字资产、数字金融规划、数字财富管理、替代融资、替代贷款、数字银行解决方案和数字业务解决方案等九个领域。

Using additional data provided by Statista, CNBC analyzed the top nations overall when it comes to financial technology, splitting the analysis into three main areas of focus:

·The countries with the most valuable fintech industries based on market capitalization.

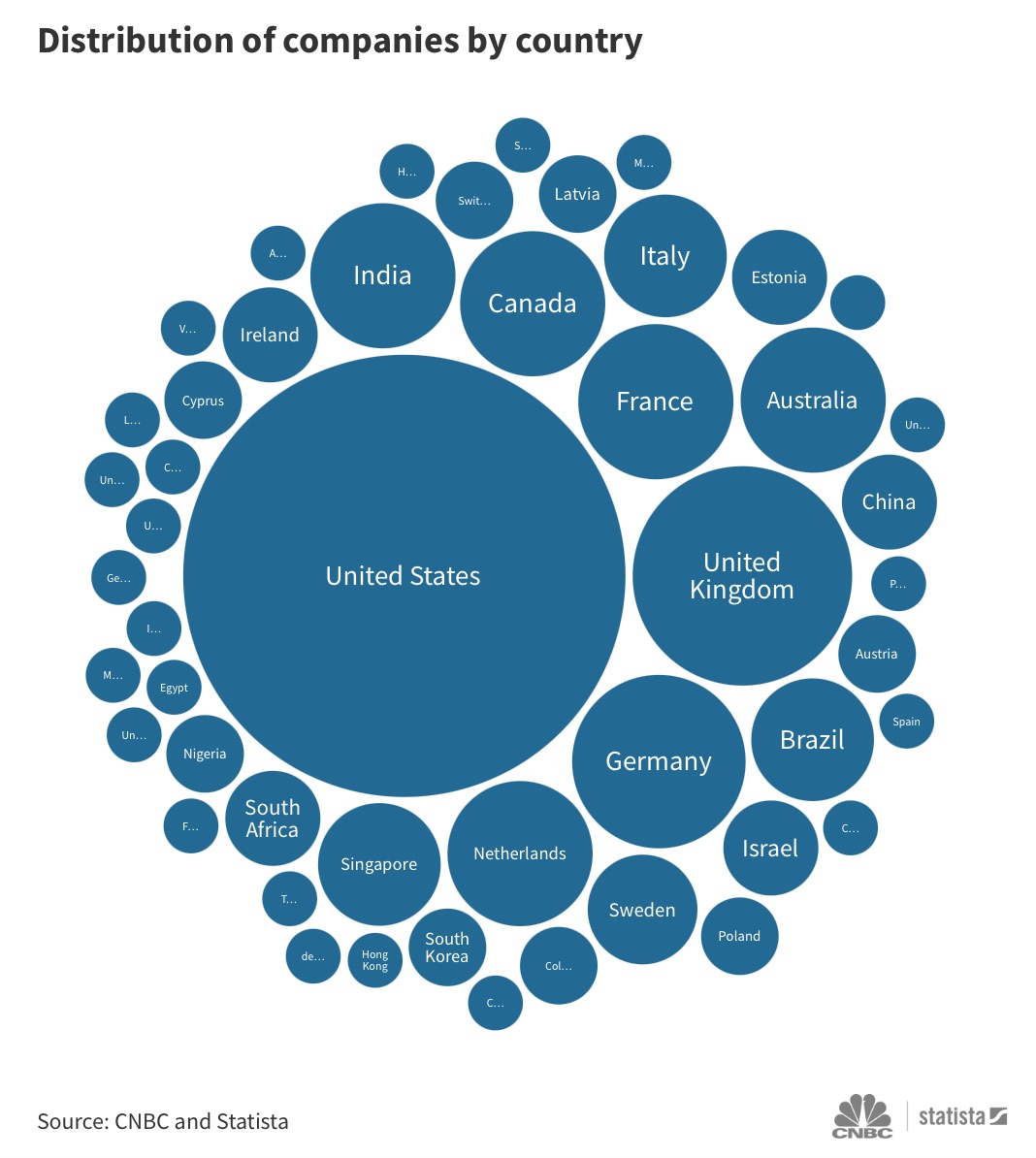

·Overall number of top fintech firms, as identified by Statista.

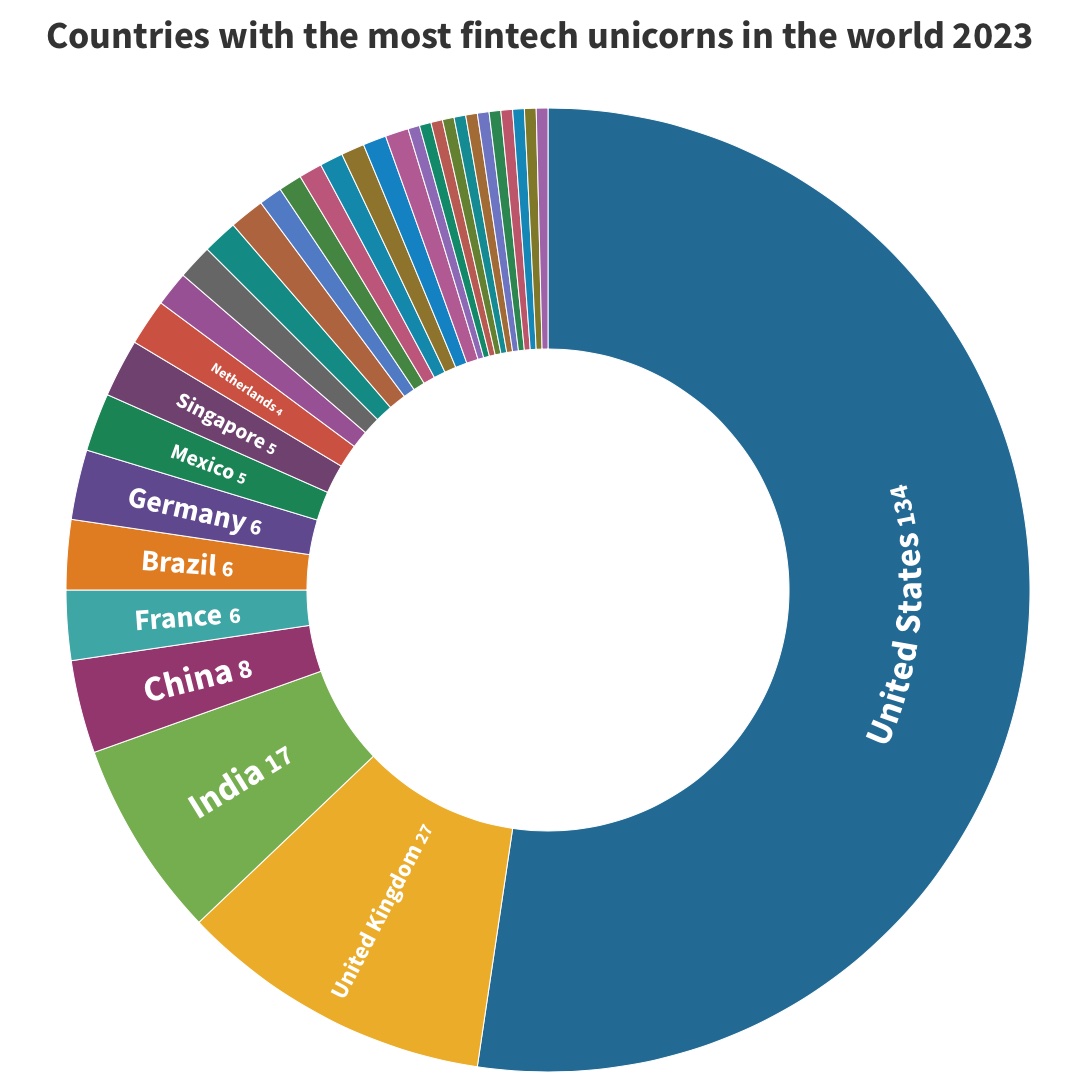

·The amount of “unicorn” companies with valuations of $1 billion or more across different countries.

使用Statista提供的额外数据,美国消费者新闻与商业频道(CNBC)分析了金融技术方面总体领先的国家,将分析集中在三个主要重点领域:

·按照市值计算,金融科技行业最有价值的的国家。

·Statista确认的顶级金融科技公司的总体数量。

·不同国家估值达到10亿美元的“独角兽”公司的数量。

So, which countries are at the top of their game when it comes to fintech? In three charts, here’s what we found.

那么,在金融科技方面,哪些国家处于领先地位?我们发现的在以下三张图表中。

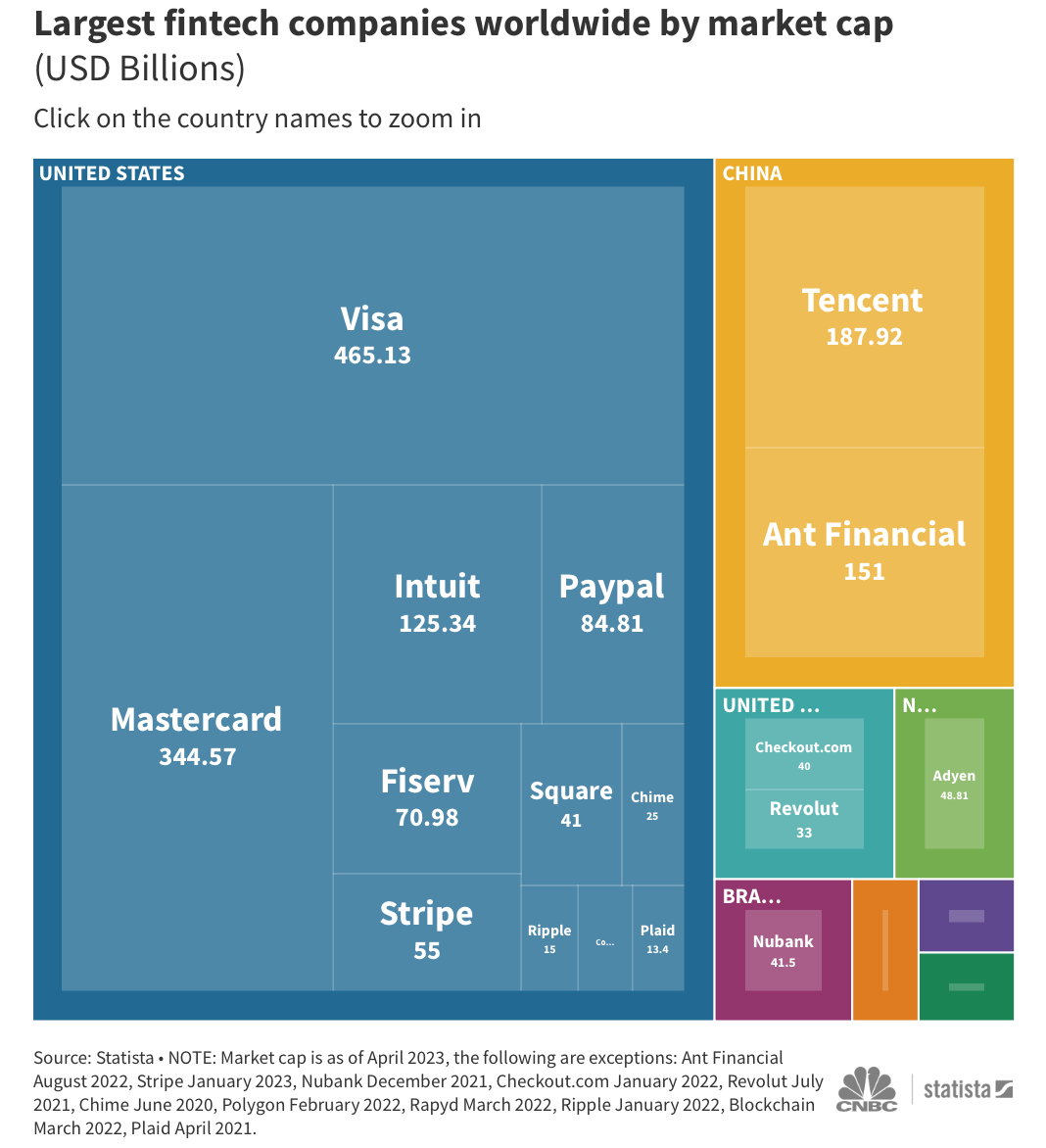

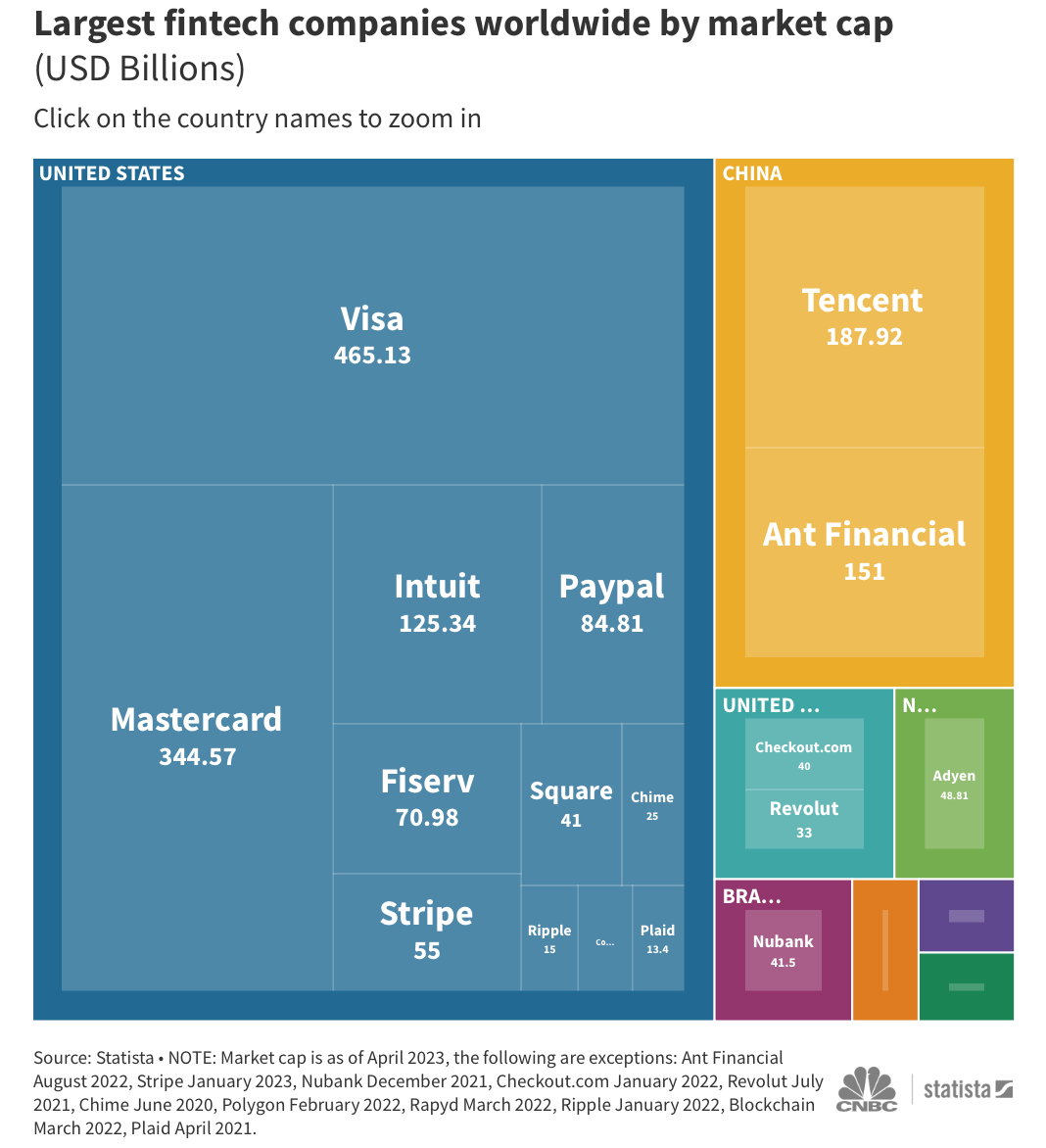

U.S., China home to most valuable fintechs

美国、中国拥有最有价值的金融科技公司

The U.S. is home to most valuable financial technology companies in the world in 2023, according to Statista data — but China isn’t far behind with mega-payments firms like Tencent and Ant Group making the country a solid second.

根据Statista的数据,2023年,美国是世界上最有价值的金融科技公司的所在地——但中国落后不远,腾讯和蚂蚁集团等大型支付公司使该国成为坚实的第二。

The valuation data is up to date as of April 2023, with the exception of Ant Group, Stripe, Nubank, Checkout.com, Revolut, Chime, Polygon, Rapyd, Ripple, Blockchain, and Plaid.

估值数据截至2023年4月,但蚂蚁集团、Stripe、Nubank、Checkout.com、Revolut、Chime、Polygon、Rapyd、Ripple、Blockchain和Plaid除外。

Combined, the U.S. produces the most value in terms of fintech, with eight of the top 15 highest-valued financial technology companies in the world worth a combined $1.2 trillion based stateside.

综合起来,美国在金融科技方面价值最高,世界上价值最高的15家金融科技公司中有8家在美国总价值1.2万亿美元。

Visa and Mastercard are the two biggest fintech firms by market value, with a collective market capitalization of $800.7 billion.

Visa和万事达卡是市值最大的两家金融科技公司,总市值为8007亿美元。

China is home to the second-most highly valued fintech industry, with its financial technology giants worth a combined $338.92 billion in total market capitalization.

中国拥有第二大价值的金融科技行业,其金融科技巨头的总市值为3389.2亿美元。

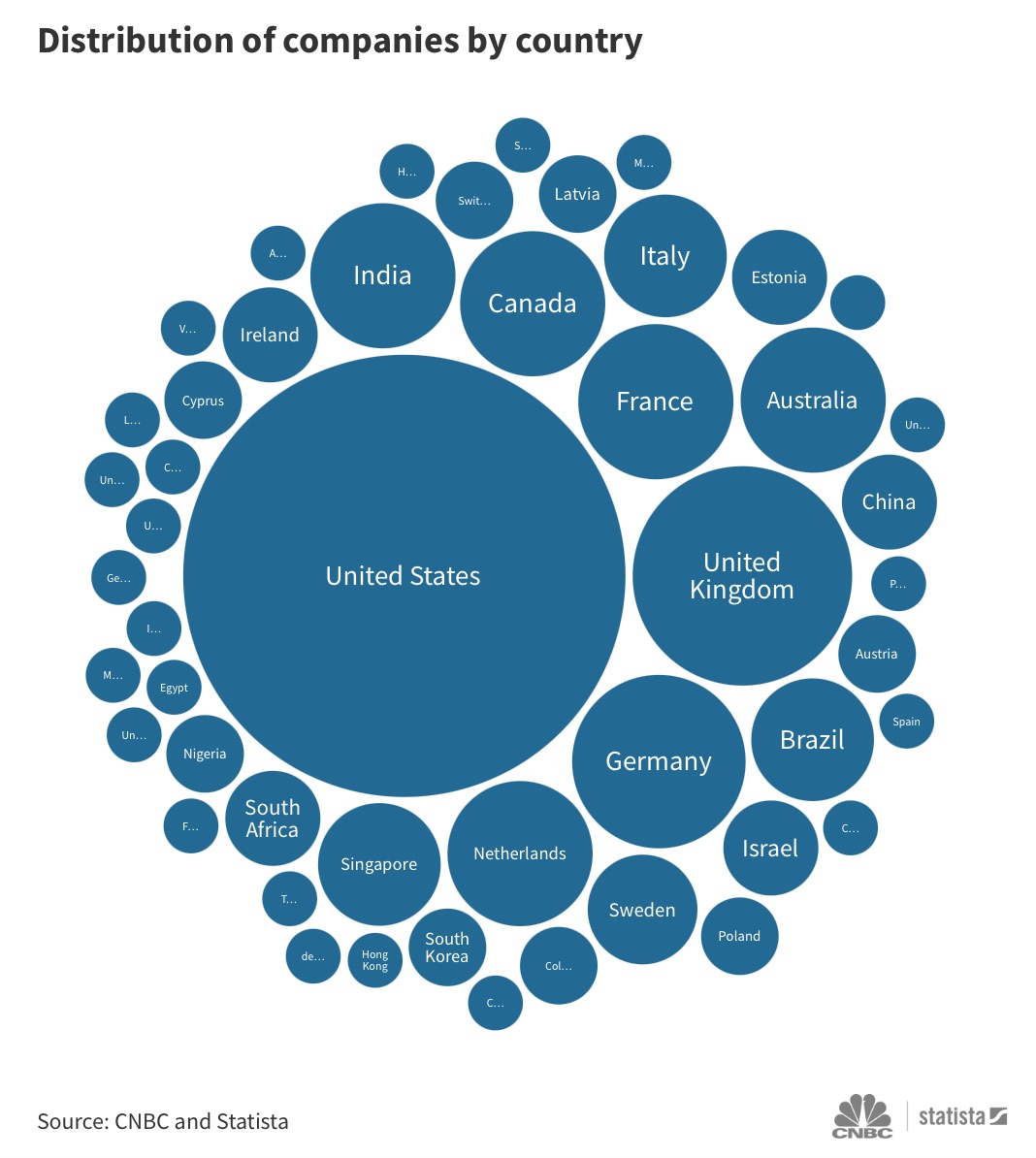

UK has second-biggest number of top fintech firms

英国拥有顶级金融科技公司数量第二多

The U.S. was home to 65 of the top fintech companies, according to CNBC’s list of world’s top 200 fintech companies. The U.K. was a close second with 15 of the top 200 fintech names globally, while the European unx is home to 55 top fintech companies.

根据CNBC的世界200强金融科技公司名单,美国拥有65家顶级金融科技公司。英国以全球200大金融科技公司中的15家紧随其后,而欧盟是55家顶级金融科技公司的所在地。

The U.S. has a vibrant fintech market, not least thanks to its deep-pocketed investors.

美国拥有充满活力的金融科技市场,这尤其要归功于其财力雄厚的投资者。

Silicon Valley is a natural home for the sector given its storied history in birthing some of the world’s largest technology companies, like Apple, Meta, Google, and Amazon, and a well-established venture capital ecosystem with major players such as Sequoia Capital and Andreessen Horowitz present.

硅谷是该行业的天然家园,因为硅谷诞生了一些世界上最大的科技公司,如苹果、梅塔、谷歌和亚马逊,并且由红杉资本和安德烈森·霍罗维茨等主要参与者组成的成熟风险资本生态系统。

In the U.S., some of the top global fintech companies on Statista’s list include names like Stripe, PayPal and Intuit. These are all companies with significant shares in their respective markets and hallmark products used by thousands, if not millions, of businesses both big and small.

在美国,Statista名单上的一些全球顶级金融科技公司包括Stripe、PayPal和Intuit等公司。这些都是在各自市场拥有巨大份额的公司,以及数千家甚至数百万家大小企业使用的标志性产品。

The U.K., similarly, has a prominent fintech industry.

同样,英国拥有显著的金融科技产业。

Buoyed by forces many — from innovation-driven regulars like the Financial Conduct Authority, to growing pools of capital, including venture and private equity, to a government that has tried to rank fintech firmly high up on its agenda — the U.K. has managed to produce significant in the fintech world, from digital banking behemoth Monzo to listed payments firm Wise.

在许多力量的推动下,从金融行为管理局等创新驱动的机构,到不断增长的资本池,包括风险投资和私募股权,再到试图将金融科技牢牢排在议程首位的政府——英国已经设法在金融科技领域取得了重要成果,从数字银行巨头Monzo到上市支付公司Wise。

In China, which was another standout fintech player identified by Statista, the market for digital financial services is massive.

中国是Statista确认的另一个杰出的金融科技参与者,那里数字金融服务市场巨大。

Tencent’s WeChat Pay and Ant Group’s Alipay have cornered the market for mobile payments, providing ample competition to its fragmented, less built-up banking sector. Consumers in China tend to have a closer relationship with digital platforms like WeChat than they have with incumbent lenders.

腾讯的微信支付和蚂蚁集团的支付宝垄断了移动支付市场,为其零碎、缺乏积累的银行业提供了充足的竞争。中国消费者与微信等数字平台的关系密切程度往往超过他们与当前贷款人的关系。

But the fintech industry is faced with a number of challenges — not least macroeconomic headwinds.

但金融科技行业面临着许多挑战——尤其是宏观方面的逆流。

Among the top roadblocks the sector faces right now, dwindling liquidity in venture capital is well up there.

在该行业目前面临的最高障碍中,风险资本流动性不断减少。

In Europe, a combination of the Russian invasion of Ukraine, the aftermath of Covid-19 lockdowns, and resulting interest rate increases have impacted most major economies.

在欧洲,俄罗斯入侵乌克兰、新冠肺炎封锁后以及由此导致的利率提高相结合,影响了大多数主要经济体。

In the U.K., meanwhile, the technology industry’s problems generally have been compounded by Brexit, which critics argue is limiting foreign investment.

与此同时,在英国,技术行业的问题通常因英国脱欧而加剧,批评者认为英国脱欧正在限制外国投资。

“The venture environment is generally struggling,” Nick Parmenter, CEO of business management consultancy Class35, told CNBC. “IPOs are fewer and lower in valuation, funds are struggling to raise from LPs and valuations are down throughout the venture cycle.”

商业管理咨询公司Class35的首席执行官Nick Parmenter告诉CNBC:“风险投资环境普遍陷入困境。”“IPO的估值越来越少,基金正在努力从LP中筹集资金,在整个风险投资周期中估值都在下降。”

“This makes raising growth capital a lot tougher, which makes management teams more conservative in their cash consumption. This has had a trickle-down effect on the fintech market — consumers have less discretionary income to invest or spend, which limits revenue potential for consumer-focused fintechs and small businesses alike.”

“这使得筹集增长资本变得更加困难,这使得管理层在现金消费方面更加保守。这对金融科技市场产生了涓滴效应——消费者投资或消费的可自由支配收入较少,这限制了以消费者为中心的金融科技和小企业的收入潜力。”

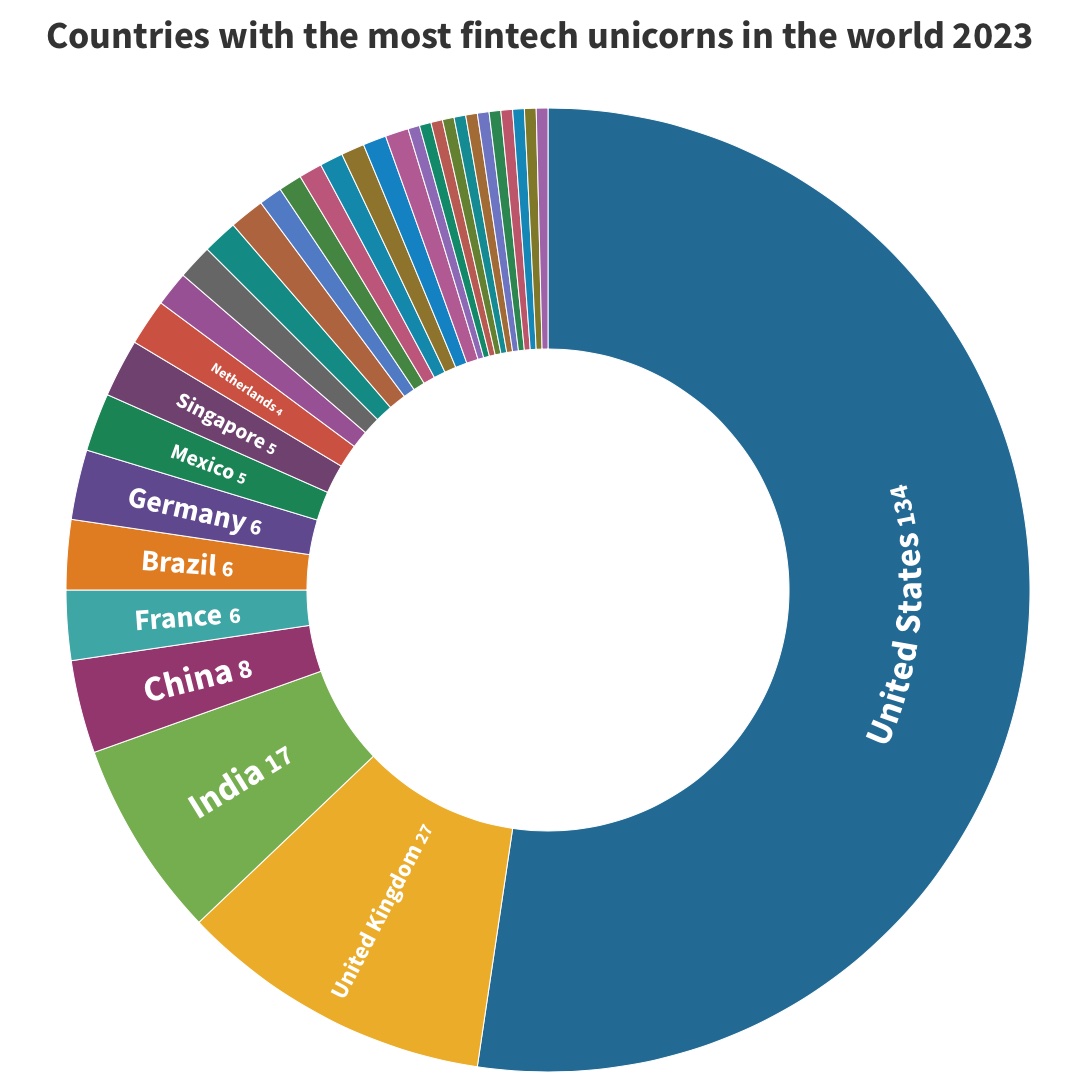

U.S. top for fintech unicorns, UK second

美国金融科技独角兽榜首,英国排名第二

The U.K. again flexes its fintech muscles when it comes to the number of richly-valued “unicorn” companies in the country — Britain stands only second to the U.S., which hosts most of the world’s fintech unicorns. Unicorns are defined as venture-backed companies with a valuation of $1 billion or more.

当谈到该国价值丰富的“独角兽”公司时,英国再次展示其金融科技力量——英国仅次于美国,美国拥有世界上大多数金融科技独角兽。独角兽被定义为估值为10亿美元或以上的风险支持型公司。

In the U.K., some of the biggest unicorns include online banking startup Revolut ($33 billion) crypto wallet provider Blockchain.com ($14 billion), and digital payments groups Checkout.com ($11 billion), Rapyd ($8.75 billion) and SumUp ($8.5 billion).

在英国,一些最大的独角兽包括在线银行初创公司Revolut(330亿美元)、加密钱包提供商Blockchain.com(140亿美元),以及数字支付集团Checkout.com(110亿美元)、Rapyd(87.5亿美元)和SumUp(85亿美元)。

Stateside, meanwhile, the largest fintech unicorns are Stripe ($95 billion), Chime ($25 billion), Ripple ($15 billion), Plaid ($13.5 billion), Devoted Health ($12.6 billion, and Brex ($12.3 billion).

与此同时,美国最大的金融科技独角兽是Stripe(950亿美元)、Chime(250亿美元)、Ripple(150亿美元)、Plaid(135亿美元)、 Devoted Health(126亿美元)和Brex(123亿美元)。

Other leading ecosystems for fintech unicorns include India, on 17 unicorns, and China, on eight. France, Brazil and Germany each have six fintech unicorns.

金融科技独角兽的其他领先生态系统包括17只独角兽的印度和8只独角兽的中国。法国、巴西和德国各有六只金融科技独角兽。

Standing in 8th place is Mexico, with five fintech unicorns, Singapore, also with five, and the Netherlands, which has four in total.

排名第八的是墨西哥,有五只金融科技独角兽,新加坡也有五只,荷兰,总共有四只。

从美国到中国,世界各国正在争夺引领金融技术的领先位置,这是一个利润丰厚的行业,从零售银行到在线财富管理,多年来一直在发展壮大。

Since the 2008 financial crisis, thousands of new firms have been set up with the aim of taking on the financial incumbents and providing more accessible services to both consumers and businesses alike.

自2008年金融危机以来,数千家新公司成立立志取代现在的金融机构,为消费者和企业提供更便捷的服务。

In the U.K., startups like Monzo and Starling took the banking world by storm with their digital-only offerings, while in China, Alibaba and Tencent launched their own respective mobile wallets, Alipay and WeChat Pay.

在英国,Monzo和Starling等初创公司通过仅提供数字产品突袭了银行界,而在中国,阿里巴巴和腾讯推出了各自的移动钱包支付宝和微信支付。

In August, CNBC, in partnership with Statista, launched a list of the world’s top fintechs. To choose the top global firms, Statista used a rigorous method that uated a few key business metrics and fundamentals, including revenue and number of employees.

8月,美国消费者新闻与商业频道(CNBC)与Statista合作,推出了一份世界顶级金融科技公司名单。为了选择全球顶级公司,Statista使用了一种严格的方法,评估了一些关键的业务指标和基本面,包括收入和员工人数。

Statista identified 200 of the top companies globally, across nine categories including neobanking, digital payments, digital assets, digital financial planning, digital wealth management, alternate financing, alternate lending, digital banking solutions, and digital business solutions.

Statista确定了全球200家顶级公司,涵盖新银行、数字支付、数字资产、数字金融规划、数字财富管理、替代融资、替代贷款、数字银行解决方案和数字业务解决方案等九个领域。

Using additional data provided by Statista, CNBC analyzed the top nations overall when it comes to financial technology, splitting the analysis into three main areas of focus:

·The countries with the most valuable fintech industries based on market capitalization.

·Overall number of top fintech firms, as identified by Statista.

·The amount of “unicorn” companies with valuations of $1 billion or more across different countries.

使用Statista提供的额外数据,美国消费者新闻与商业频道(CNBC)分析了金融技术方面总体领先的国家,将分析集中在三个主要重点领域:

·按照市值计算,金融科技行业最有价值的的国家。

·Statista确认的顶级金融科技公司的总体数量。

·不同国家估值达到10亿美元的“独角兽”公司的数量。

So, which countries are at the top of their game when it comes to fintech? In three charts, here’s what we found.

那么,在金融科技方面,哪些国家处于领先地位?我们发现的在以下三张图表中。

U.S., China home to most valuable fintechs

美国、中国拥有最有价值的金融科技公司

The U.S. is home to most valuable financial technology companies in the world in 2023, according to Statista data — but China isn’t far behind with mega-payments firms like Tencent and Ant Group making the country a solid second.

根据Statista的数据,2023年,美国是世界上最有价值的金融科技公司的所在地——但中国落后不远,腾讯和蚂蚁集团等大型支付公司使该国成为坚实的第二。

The valuation data is up to date as of April 2023, with the exception of Ant Group, Stripe, Nubank, Checkout.com, Revolut, Chime, Polygon, Rapyd, Ripple, Blockchain, and Plaid.

估值数据截至2023年4月,但蚂蚁集团、Stripe、Nubank、Checkout.com、Revolut、Chime、Polygon、Rapyd、Ripple、Blockchain和Plaid除外。

Combined, the U.S. produces the most value in terms of fintech, with eight of the top 15 highest-valued financial technology companies in the world worth a combined $1.2 trillion based stateside.

综合起来,美国在金融科技方面价值最高,世界上价值最高的15家金融科技公司中有8家在美国总价值1.2万亿美元。

Visa and Mastercard are the two biggest fintech firms by market value, with a collective market capitalization of $800.7 billion.

Visa和万事达卡是市值最大的两家金融科技公司,总市值为8007亿美元。

China is home to the second-most highly valued fintech industry, with its financial technology giants worth a combined $338.92 billion in total market capitalization.

中国拥有第二大价值的金融科技行业,其金融科技巨头的总市值为3389.2亿美元。

UK has second-biggest number of top fintech firms

英国拥有顶级金融科技公司数量第二多

The U.S. was home to 65 of the top fintech companies, according to CNBC’s list of world’s top 200 fintech companies. The U.K. was a close second with 15 of the top 200 fintech names globally, while the European unx is home to 55 top fintech companies.

根据CNBC的世界200强金融科技公司名单,美国拥有65家顶级金融科技公司。英国以全球200大金融科技公司中的15家紧随其后,而欧盟是55家顶级金融科技公司的所在地。

The U.S. has a vibrant fintech market, not least thanks to its deep-pocketed investors.

美国拥有充满活力的金融科技市场,这尤其要归功于其财力雄厚的投资者。

Silicon Valley is a natural home for the sector given its storied history in birthing some of the world’s largest technology companies, like Apple, Meta, Google, and Amazon, and a well-established venture capital ecosystem with major players such as Sequoia Capital and Andreessen Horowitz present.

硅谷是该行业的天然家园,因为硅谷诞生了一些世界上最大的科技公司,如苹果、梅塔、谷歌和亚马逊,并且由红杉资本和安德烈森·霍罗维茨等主要参与者组成的成熟风险资本生态系统。

In the U.S., some of the top global fintech companies on Statista’s list include names like Stripe, PayPal and Intuit. These are all companies with significant shares in their respective markets and hallmark products used by thousands, if not millions, of businesses both big and small.

在美国,Statista名单上的一些全球顶级金融科技公司包括Stripe、PayPal和Intuit等公司。这些都是在各自市场拥有巨大份额的公司,以及数千家甚至数百万家大小企业使用的标志性产品。

The U.K., similarly, has a prominent fintech industry.

同样,英国拥有显著的金融科技产业。

Buoyed by forces many — from innovation-driven regulars like the Financial Conduct Authority, to growing pools of capital, including venture and private equity, to a government that has tried to rank fintech firmly high up on its agenda — the U.K. has managed to produce significant in the fintech world, from digital banking behemoth Monzo to listed payments firm Wise.

在许多力量的推动下,从金融行为管理局等创新驱动的机构,到不断增长的资本池,包括风险投资和私募股权,再到试图将金融科技牢牢排在议程首位的政府——英国已经设法在金融科技领域取得了重要成果,从数字银行巨头Monzo到上市支付公司Wise。

In China, which was another standout fintech player identified by Statista, the market for digital financial services is massive.

中国是Statista确认的另一个杰出的金融科技参与者,那里数字金融服务市场巨大。

Tencent’s WeChat Pay and Ant Group’s Alipay have cornered the market for mobile payments, providing ample competition to its fragmented, less built-up banking sector. Consumers in China tend to have a closer relationship with digital platforms like WeChat than they have with incumbent lenders.

腾讯的微信支付和蚂蚁集团的支付宝垄断了移动支付市场,为其零碎、缺乏积累的银行业提供了充足的竞争。中国消费者与微信等数字平台的关系密切程度往往超过他们与当前贷款人的关系。

But the fintech industry is faced with a number of challenges — not least macroeconomic headwinds.

但金融科技行业面临着许多挑战——尤其是宏观方面的逆流。

Among the top roadblocks the sector faces right now, dwindling liquidity in venture capital is well up there.

在该行业目前面临的最高障碍中,风险资本流动性不断减少。

In Europe, a combination of the Russian invasion of Ukraine, the aftermath of Covid-19 lockdowns, and resulting interest rate increases have impacted most major economies.

在欧洲,俄罗斯入侵乌克兰、新冠肺炎封锁后以及由此导致的利率提高相结合,影响了大多数主要经济体。

In the U.K., meanwhile, the technology industry’s problems generally have been compounded by Brexit, which critics argue is limiting foreign investment.

与此同时,在英国,技术行业的问题通常因英国脱欧而加剧,批评者认为英国脱欧正在限制外国投资。

“The venture environment is generally struggling,” Nick Parmenter, CEO of business management consultancy Class35, told CNBC. “IPOs are fewer and lower in valuation, funds are struggling to raise from LPs and valuations are down throughout the venture cycle.”

商业管理咨询公司Class35的首席执行官Nick Parmenter告诉CNBC:“风险投资环境普遍陷入困境。”“IPO的估值越来越少,基金正在努力从LP中筹集资金,在整个风险投资周期中估值都在下降。”

“This makes raising growth capital a lot tougher, which makes management teams more conservative in their cash consumption. This has had a trickle-down effect on the fintech market — consumers have less discretionary income to invest or spend, which limits revenue potential for consumer-focused fintechs and small businesses alike.”

“这使得筹集增长资本变得更加困难,这使得管理层在现金消费方面更加保守。这对金融科技市场产生了涓滴效应——消费者投资或消费的可自由支配收入较少,这限制了以消费者为中心的金融科技和小企业的收入潜力。”

U.S. top for fintech unicorns, UK second

美国金融科技独角兽榜首,英国排名第二

The U.K. again flexes its fintech muscles when it comes to the number of richly-valued “unicorn” companies in the country — Britain stands only second to the U.S., which hosts most of the world’s fintech unicorns. Unicorns are defined as venture-backed companies with a valuation of $1 billion or more.

当谈到该国价值丰富的“独角兽”公司时,英国再次展示其金融科技力量——英国仅次于美国,美国拥有世界上大多数金融科技独角兽。独角兽被定义为估值为10亿美元或以上的风险支持型公司。

In the U.K., some of the biggest unicorns include online banking startup Revolut ($33 billion) crypto wallet provider Blockchain.com ($14 billion), and digital payments groups Checkout.com ($11 billion), Rapyd ($8.75 billion) and SumUp ($8.5 billion).

在英国,一些最大的独角兽包括在线银行初创公司Revolut(330亿美元)、加密钱包提供商Blockchain.com(140亿美元),以及数字支付集团Checkout.com(110亿美元)、Rapyd(87.5亿美元)和SumUp(85亿美元)。

Stateside, meanwhile, the largest fintech unicorns are Stripe ($95 billion), Chime ($25 billion), Ripple ($15 billion), Plaid ($13.5 billion), Devoted Health ($12.6 billion, and Brex ($12.3 billion).

与此同时,美国最大的金融科技独角兽是Stripe(950亿美元)、Chime(250亿美元)、Ripple(150亿美元)、Plaid(135亿美元)、 Devoted Health(126亿美元)和Brex(123亿美元)。

Other leading ecosystems for fintech unicorns include India, on 17 unicorns, and China, on eight. France, Brazil and Germany each have six fintech unicorns.

金融科技独角兽的其他领先生态系统包括17只独角兽的印度和8只独角兽的中国。法国、巴西和德国各有六只金融科技独角兽。

Standing in 8th place is Mexico, with five fintech unicorns, Singapore, also with five, and the Netherlands, which has four in total.

排名第八的是墨西哥,有五只金融科技独角兽,新加坡也有五只,荷兰,总共有四只。

评论翻译

无

很赞 ( 4 )

收藏