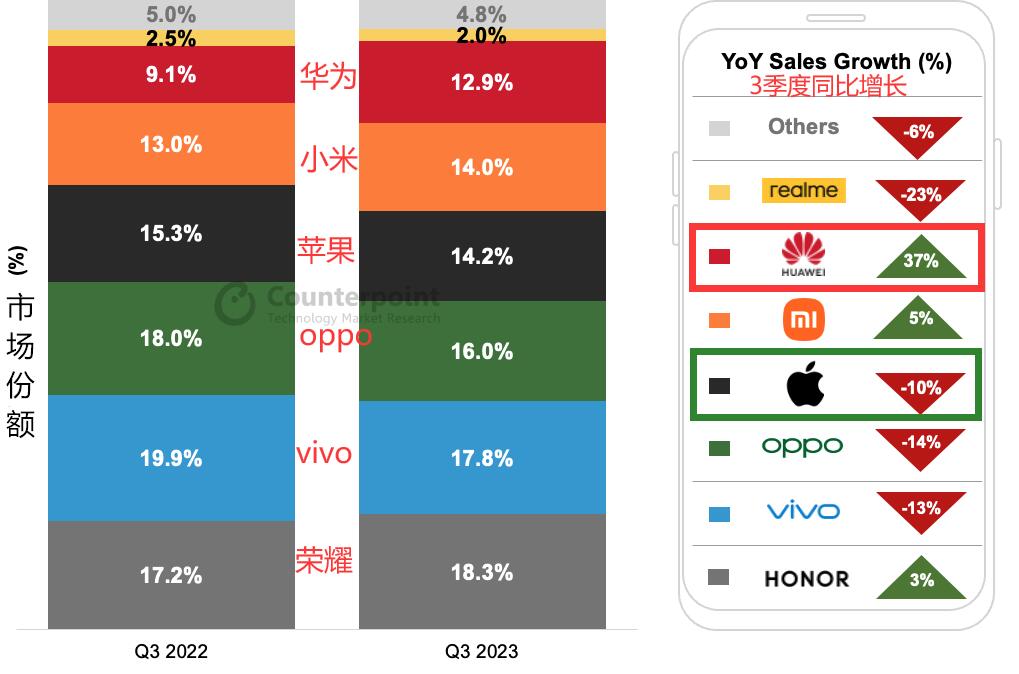

2023年第三季度,华为手机同比增长37%,苹果等品牌同比下降超过10%

2023年第三季度,华为手机同比增长37%,苹果等品牌同比下降超过10%

Q3 2023 China Smartphone Sales Fall 3% Signaling Recovery Getting Closer

译文简介

2023年第三季度,中国智能手机销量同比下降3%,这表明市场可能正接近触底。

正文翻译

中国市场:

In Q3 2023, smartphone sales in China declined 3% YoY in a sign the market could be closer to bottoming out.

2023年第三季度,中国智能手机销量同比下降3%,这表明市场可能正接近触底。

Huawei was the big winner, growing 37% YoY on the back of the newly launched Mate 60 series, which is powered by its SoC Kirin 9000S. Major OEMs’ performance varied significantly YoY, which resulted in market ranking changes. HONOR took the top spot as vivo and OPPO lost significant ground. Apple lost share

华为是大赢家,同比增长37%,得益于新发布的Mate 60系列,这款手机搭载自家芯片麒麟9000S。除华为外,主要手机厂商的表现与去年同期相比差异显著,导致了市场份额排名的变化。荣耀夺得第一名,而vivo和OPPO大幅丧失份额。苹果的市场份额有所下滑。

During Q3 2023, the performance of most leading OEMs except Huawei was lackluster. On the back of the Kirin SoC’s return, Huawei launched the Mate 60 Pro suddenly at the end of August. It has made a huge splash in the market, contributing big to Huawei’s smartphone sales growth of 37% YoY in Q3 2023. Huawei is striving to ramp up production to catch up with the demand.

在2023年第三季度,除华为外,大多数主要手机厂商的表现不佳。凭借麒麟芯片的回归,华为在8月底突然发布了Mate 60 Pro,在市场上引起了巨大反响,大大推动了华为在2023年第三季度智能手机销量同比增长37%。华为正努力增加产量以满足市场需求。

HONOR led the market with an 18.3% share largely driven by the newly launched HONOR X50 and HONOR 90. xiaomi increased YoY on the back of strong sales of the Redmi K and Note series driven by competitive promotional prices.

荣耀以18.3%的市场份额领跑中国市场,主要得益于新近推出的荣耀X50和荣耀90。小米凭借红米K系列和Note系列的强劲销售,同笔实现了增长,这主要是由于其具有竞争力的促销价格。

OPPO, vivo and Apple all experienced double-digit decreases in sales. Lam said, “iPhone sales declined as some demand for older models was fulfilled in Q1 and Q2 2023 due to earlier-than-expected price cuts by channels. This was compounded by initial supply constraints faced by the iPhone 15 series, which resulted in lower sales compared to the iPhone 14 series for the launch period. However, traditional offline dominators OPPO and vivo were impacted by weaker spending in Tier 2 and lower cities, as well as being slightly less aggressive in promotions than HONOR and xiaomi.”

OPPO、vivo和苹果的销售都出现了两位数的下滑。“由于渠道提前降价,一些对旧款iPhone的需求在2023年第一季度和第二季度得到了满足,再加上iPhone 15系列初期面临供应限制,导致其发布期间的销量低于iPhone 14系列。传统线下市场霸主OPPO和vivo受到二线及以下城市消费能力减弱的影响,以及他们在促销活动上相较荣耀和小米稍显保守。”

During the quarter, sales of foldable smartphone models continued to grow. The OPPO Find N2 Flip remained the top-selling clamshell-type foldable, while the HONOR Magic V2 ranked first among book-type models.

本季度,折叠屏智能手机销量持续增长。OPPO Find N2 Flip仍然是最畅销的翻盖式折叠手机,而荣耀Magic V2是向内折叠手机的第一名。

全球市场:

Global smartphone sell-through volumes fell 8% YoY in Q3 2023, the ninth consecutive quarter to record a decline, but grew 2% QoQ, according to the latest research from Counterpoint’s Market Pulse service. Volumes declined YoY largely due to slower than expected recovery in consumer demand.

2023年第三季度全球智能手机出货量同比下降8%,这是连续第九个季度下降,但环比增长2%。销量同比下降主要是由于消费者需求恢复速度慢于预期。

Samsung continued to lead the global market, capturing a fifth of the total sales in Q3. Apple came in second with a 16% market share despite the limited availability of iPhone 15 series, which has been received well so far.

三星继续领跑全球市场,在第三季度占销量的五分之一。苹果以16%的市场份额位居第二,尽管iPhone 15系列供应有限,但至今反响良好。

xiaomi, OPPO and vivo rounded off the top five, with the three recording YoY declines. In Q3, all these brands worked towards strengthening their positions in key markets like China and India, while continuing to slow down expansionary efforts in overseas markets.

小米、OPPO和vivo紧随其后,三家企业均出现同比下滑。在第三季度,这些品牌都在努力巩固它们在中国和印度等关键市场的地位,同时继续放缓在海外市场的扩张步伐。

HONOR, Huawei and Transsion Group gained share and were among the only brands to record YoY growth in Q3. Huawei grew driven by the launch of the Mate 60 series in China, while HONOR’s growth was led by strong overseas performance. Transsion brands continued to expand while also benefiting from the recovery in the Middle East and Africa (MEA) market.

荣耀、华为和传音是少数几家在第三季度实现同比增长并获得更多市场份额的品牌。华为的增长得益于Mate 60系列在中国的发布,而荣耀的增长则主要由其海外表现强劲所驱动。传音品牌持续扩张,并从中东和非洲市场的复苏中受益。

评论翻译

很赞 ( 37 )

收藏

Sin

It's great too see Huawei is making a comeback!

看到华为正在复苏,太好了!

Vinaigre

Yes! But the question is when?

I am waiting for something new in the EU with the Kirin chipset.

是的!但是问题是什么时候?我正在等待华为在欧盟推出采用麒麟芯片的新产品。

Anonymous

I will forever say, the hardware they make - great...at the time the sanctions started, pretty much no OEM could compete in terms of price-performance.

...but the software side (specifically talking in the west) failed miserably to live up to the specs - many MANY phones were literally left never to receive an upxe beyond a few security patches (which were also rarely on-time), with the worst part being - they decided to hide the actual Android version used on the devices and only leave the UI version visible, later claiming "yes we upxed them!" while in reality only the UI was upxed...

I doubt they'll ever get back to where they were globally, but in China, I'm sure they will be juuuuuust fine, their customers there did not get the same treatment the rest of us did.

我会一直说,他们制造的硬件——太棒了。在制裁开始时,几乎没有任何设备制造商能在性价比方面与之匹敌。

但是,在软件方面(特别是在西方),他们却未能达到期望——许多手机从未获得更新,除了少数安全补丁(这些也很少按时发布)。最糟糕的是——他们决定隐藏设备上实际的安卓版本,只显示用户界面版本,后来声称“我们已经更新它们了!”而实际上只更新了用户界面。

我怀疑他们能否重新回到以前在全球的地位,但在中国,我确信他们会很好,那里的客户没有遇到我们其他地方用户的经历。

David 040882

Yeah, too bad that the comeback is only having an effect on China....a global comeback however, is what we need from Huawei

是啊,太可惜了,回归的影响只局限于中国……然而,我们真正需要的是华为在全球范围内的回归。

Game Legion

China is biggest market for smartphones, every process is gradual

中国是智能手机最大的市场,所有过程都是逐步推进的。

David 040882

Gradual, yes; but I don't know what process Huawei is doing by not releasing, for example, the Mate 60 series globally. I mean, I completely understand why they wouldn't release it to the global market, but their flagship series are pretty much the only good offerings from Huawei. They're not really putting too much effort on the low-budget/midrange area. So by keeping what's best China-exclusive, I don't know what process they could really make.

是的,华为的步伐确实很稳健;但我不明白他们为什么不在全球范围内发布比如Mate 60系列这样的产品。我完全理解他们为何不将其推向全球市场,但他们的旗舰系列基本上就是华为唯一值得称道的产品。他们并没有在低价位/中端市场投入太多精力。那么,让最好的产品只在中国销售,我真不知道他们能怎样推进。

Hemedans

They don't want to bother with Patents battle.

他们不想被专利战拖累。

Invetor

They (Huawei) are trying to keep up with the local demand. After they do that, they can think about the other regions.

他们(华为)正在努力满足本地需求。在做到这一点之后,他们才能考虑其他区域。

alcatraz

This is true. My friend in China got offered a new phone at work. 90% of the entire work force there chose the Mate 60, and now 1-2 months later they still haven't received their phones. My friend chose a Redmi and got his a long time ago. So Huawei are trying to supply them. As soon as it stabilizes I hope to see prices drop and Kirin chips in other brands' phones/tablets, as well as in the rest of the Huawei lineup.

这是真的,我在中国的朋友在工作中会被提供一部新手机。那里90%的员工都选择了Mate 60,现在1-2个月过去了,他们还没有拿到手机。我的朋友选择了红米手机,很早就拿到手了。所以华为正在努力供应。我希望一旦情况稳定下来,能看到降价,并希望看到麒麟芯片应用于其他品牌的手机/平板电脑,以及华为其他产品中。

Vinaigre

90% have chosen the Mate 60 PRO?

They are real patriots!

90%的人选择了Mate 60 Pro?他们真是爱国者!

Anonymous

It's the same as in US office....

80% chose fruity

这和美国办公室情况一样……80%选择了水果机。

Aierlan

Exactly. Almost impossible to buy a Mate 60 series phone in China for the normal price. There's a big waiting list

没错。在中国,想要以正常价格购买Mate 60系列手机几乎是不可能的事情。现在还有长长的等待名单呢。

Vinaigre

Yep prices are crazy.

The Mate 60 Porsche design is between 3500€ and 4500€ depending on the color. LOL

是的,价格真疯狂。Mate 60保时捷设计版价格在3500欧元到4500欧元之间,取决于颜色,哈哈。

Lister

I know China is a big industrial country but it’s amazing how many phones it produces. I’m guessing the industry has strong backing by the Government?

It would be nice to see more competition from the EU and other Asian markets.

我知道中国是一个工业大国,但生产的手机数量着实令人惊讶。我猜这个行业得到了政府的大力支持?如果欧盟和其他亚洲市场能有更多的竞争就好了。

babak

they can't,nokia eu mades are mostly lowend phones and in japan, sharp is only sell in japan and sony only in some european country. so Chinese manufacturers have no competitors from outside of china,whatever ghey do they compete with eachother

他们做不到,诺基亚欧洲制造的手机大多是低端机,日本品牌,夏普只在日本销售,索尼只在一些欧洲国家销售。所以中国制造商在中国之外没有竞争对手,不管他们做什么,都只是他们彼此之间的竞争

potato4k

Eh, what people seems to be missing is the fact that BBK is having more than a third (35%, Oppo + Vivo + Realme) of the market. That's crazy. Imagine one in three phones sold there is a BBK phone...

嗯,似乎人们忽视了一个事实:步步高(vivo、OPPO和Realme)合计占据了三分之一(35%)的市场份额,这简直太疯狂了。想象一下,中国每卖出3部手机就有1部是步步高的。

Anonymous

Oppo, Vivo, realme all down.

OPPO、vivo、realme全都下滑。

David 040882

Well, they better hurry cause in no time, there won't be any more room for Huawei on the global market. Competition is growing from all sides

不过,他们最好抓紧时间,因为很快,在全球市场上将没有华为的立足之地。来自四面八方的竞争正在加剧。

Anonymous

Bold of you to think the status quo remains forever. My friends still swear by Huawei's hardware, esp the camera, but they needed GMS for work.

This company would've dislodged Samsung if only US govt didn't come to their South Korean ally rescue.

你真是敢想,竟然认为现状会永远保持下去。我的朋友们仍然对华为的硬件,尤其是相机赞不绝口,只是他们工作中需要谷歌服务。如果不是美国政府出手援救了他们的韩国盟友三星,华为这家公司本可以打败三星的。

David 040882

Yeah, I outright agree with you. But what's the reality? Not want we want. Huawei got banned and has lost a ton of its global market share. It's nearly impossible for them to rise back to the status they once had with so many other huge brands that have much more market share and to say the least, more "popularity". Oh and tell your friends that they can access Google Play Services through G-Box in case you didn't know that

是的,我完全同意你的看法。但现实呢?并非我们想的那样。华为被禁,丧失了大量的全球市场份额。在如此多的其他大品牌占据更多市场份额的情况下,要重新回到他们曾经的地位几乎是不可能的,更不用说这些品牌至少在“人气”方面占优。哦,如果你不知道的话,可以告诉你的朋友,通过G-Box可以使用谷歌商店。

Anonymous

China is already beating US even outside smartphone stuff but foreign media doesn't report them since it does not instill outrage.

即使在智能手机以外的领域,中国也正在打败美国,但外国媒体不报道,因为这不会引发愤怒。

Anonymous

People commenting like Huawei wasn't selling the most phones before the US sanctions hit. Huawei is reclaiming lost ground and beating US sanctions at the same time.

评论的人好像不知道华为在遭到美国制裁之前是最畅销的手机。华为正在收复失地,同时也击败美国的制裁。

David 040882

Fair enough, but they'll slowly become China exclusive and the world will slowly forget about Huawei. They want to make a comeback, then they better do it as soon as they can, with all the risks involved

说得也对,但华为会慢慢变成只在中国市场独占鳌头,世界将逐渐忘记华为。如果他们想要东山再起,那么最好尽早行动,并承担所有的风险。

Anonymous

There's still lots of teenager want to up their "value" with brands and think can increase their value

还有很多青少年想通过品牌来提升自己的身价,并认为能增加自己的价值

Ouifuf

This is where apple gets a lot of their sales from. There's a lot of people who think an iPhone is a symbol of wealth so they only buy iphones for that reason. In my country schoolkids make fun of other schoolkids for using android phones, calling them poor. Doesn't make sense since a lot of android phones cost more then iphones but is what it is.

这就是苹果公司大量销售的来源。有很多人认为iPhone是财富的象征,他们购买iPhone就是这个原因。在我的国家,使用苹果手机的学生会嘲笑其他使用安卓手机的学生,说他们很穷。这说不通,因为许多安卓手机的价格比iPhone更贵,但情况就是这样。

alcatraz

If I hadn't been offered a Samsung at an amazing price I woulen't mind to go with another Huawei/Kirin phone. I used one for 6 years and I was very happy. I'm not crazy about the locked bootloader or the lack of a global rom based on android. Please Huawei! If you only do Harmony I'd rather support with another brand but with a Kirin chipset.

I love the idea how Kirin and Huawei chips shift the balance of power in the market. More competition will help consumers tremendously! If Huawei becomes big, Qualcomm will EASILY surpass the performance of Apple. It's just that right now they have no reason to.

如果不是三星手机的价格优惠的惊人,我其实并不介意再选择一款华为/麒麟的手机。我用了六年华为手机,非常满意。虽然我不喜欢锁定的引导程序和缺乏基于安卓系统的全球ROM,还是希望华为能改进这些问题!如果你们只做鸿蒙系统,那我宁愿支持使用麒麟芯片组的其他品牌。

我喜欢华为和麒麟芯片改变市场力量平衡的想法。更多的竞争将极大地有利于消费者!如果华为变得足够强大,高通的性能将轻松超过苹果。只是现在他们没有动力去这么做。

Faruk Ahmed

Congratulations Huawei

祝贺华为

Rodolf

Well done Huawei

Competition is good for us! Now into the global markets to regain at least the 3rd spot which will force Samsung and Apple to offer more features and better specs for same or less cost.

华为干得好。竞争对我们有利! 现在进入全球市场,至少重夺第3名,这将迫使三星和苹果以相同或更低的价格提供更多功能和更好的规格。

rizki1

China still likes homemade phones and no wonder they are rising even globally...

中国仍然喜欢自主品牌的手机,难怪这些手机在全球范围内也越来越受欢迎……