安倍晋三因为什么被暗杀?(一)

安倍晋三因为什么被暗杀?(一)

Why Shinzo Abe Was Assassinated: Towards a ‘United States of Europe’ and a League of Nations

译文简介

正如我在论文《日本愿意为美国重返亚洲战略自刎吗?》中讨论的,本文是对该问题的后续研究,日本已经成为世界经济的定时炸弹。

正文翻译

As already discussed in my paper “Is Japan Willing to Cut its Own Throat in Sacrifice to the U.S. Pivot to Asia?”, to which this paper is a follow-up, Japan has become the ticking time bomb for the world economy.

正如我在论文《日本愿意为美国重返亚洲战略自刎吗?》中讨论的,本文是对该问题的后续研究,日本已经成为世界经济的定时炸弹。

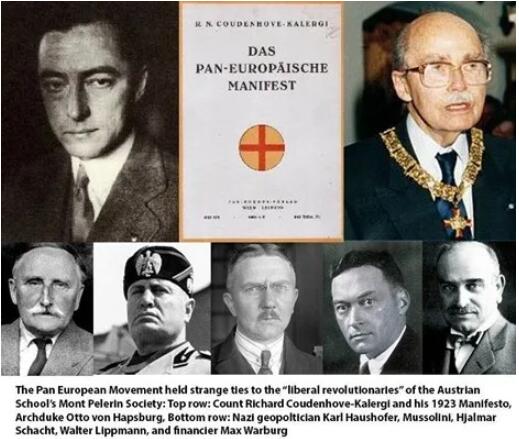

This is not an unexpected outcome for Japan but has been in the works for the last 50 years as a policy outlook of the Trilateral Commission (though is not limited to this institution). It is in fact the League of Nations’ vision that has been on the wish list of those who began WWI in hopes that the world would accept a one world government of regionalisations in service to an empire. It is what orchestrated the Great Depression to again attempt an implementation of a League of Nations outlook through the rise of a “National Socialist” brand of fascism seen in Italy and Germany (which would not have been possible without an economic crisis). And it was what launched a Second World War in a desperate attempt to forcefully implement such a vision onto the world (for more this refer here and here.)

这对日本来说并不是一个意外的结果,但在过去50年里,这一直是三边委员会的政策展望(尽管并不仅限于该机构)。事实上,国际联盟的愿景一直在那些发动第一次世界大战的人的愿望清单上,他们希望世界能够接受一个为帝国服务的区域化世界政府。正是它精心策划了大萧条,让意大利和德国的“国家社会党”法西斯主义崛起(如果没有经济危机,这是不可能的),从而再次试图实施国际联盟的观点。正是它发动了第二次世界大战,不顾一切地试图在世界上强制实施这一愿景。

(三边委员会是北美、西欧和日本三个地区十四个国家的民间组织。)

It has always been about obtaining a League of Nations organization for the world and those who have called themselves democrats have often found themselves in the same room as those who called themselves fascists in order to see such a vision through.

As Count Richard Coudenhove-Kalergi, the father of Pan-Europeanism (who happened to also be pro-fascist), wrote in his 1943 autobiography “A Crusade for Pan-Europe”:

“The Anti-Fascists hated Hitler…yet they…paved the way to his successes. For these anti-Fascists succeeded in transforming Mussolini, Hitler’s strongest enemy during the years of 1933 and 1934, into Hitler’s strongest ally. I don’t blame the Italian and Spanish anti-Fascists for their brave and very natural fight against their ruthless political enemies. But I blame the democratic politicians, especially in France…they treated Mussolini as an ally of Hitler till he became one.”

这一直是为了建立一个国际联盟组织,那些自称为民主党人的人常常发现自己与那些自称为法西斯主义者的人站在同一个房间里,来实现这样一个愿景。

正如泛欧洲主义之父理查德·库登霍夫-卡勒吉伯爵(碰巧也是亲法西斯主义者)在1943年的自传《泛欧洲的十字军东征》中所写:

“反法西斯主义者憎恨希特勒……然而他们……为他的成功铺平了道路。”因为这些反法西斯主义者成功地将希特勒在1933年和1934年期间最强大的敌人墨索里尼变成了希特勒最强大的盟友。我不责怪意大利和西班牙的反法西斯主义者,因为他们勇敢而本能地与无情的政治敌人进行斗争。但我责怪那些民主的政治家,尤其是法国的政治家……他们视墨索里尼为希特勒的盟友,直到墨索里尼真变成希特勒的盟友。”

According to Kalergi, and many other ‘elites’ of similar pedigree, it was an inevitability that a fascist Pan-European rule should occur, and Kalergi expressed his clear disdain for anti-fascist and democratic resistance to this ‘inevitability’. From Kalergi’s standpoint, because of the anti-fascist and democratic resistance to a more ‘peaceful’ transference to fascism, they had created a situation where fascism would have to be imposed on them with violent force. It was a tragedy in the eyes of Kalergi that could have been avoided if these countries had simply accepted fascism on ‘democratic’ terms.

根据卡勒吉和其他许多类似背景的“精英”的说法,法西斯主义泛欧统治的出现是不可避免的,卡勒吉明确表达了他对反法西斯和民主抵抗这种“必然性”的蔑视。从卡尔吉的观点来看,由于反法西斯和民主抵抗更加“和平”地向法西斯主义转移,他们造成了一种法西斯主义必须以暴力手段强加给他们的局面。在卡尔吉看来,这是一场悲剧,如果这些国家仅仅以“民主”的条件接受法西斯主义,这是可以避免的。

Count Richard Coudenhove-Kalergi would write in his other autobiography “An Idea Conquers the World”:

“The use of mass hypnotism for propaganda purposes is most successful at times of crisis. When National Socialism made its bid for power, millions of Germans had been thrown completely off their balance: middle-class families had sunk to the level of the proletariat, whilst working-class families were without work. The Third Reich became the last hope for the stranded, of those who had lost their social status, and of those rootless beings who were seeking a new basis for an existence that had become meaningless…

理查德·库登霍夫-卡勒吉伯爵在他的另一本自传《思想征服世界》中写道:

“为了宣传目的而使用大规模催眠在危机时期最为成功。

当纳粹主义试图夺取政权时,数百万德国人完全失去了平衡:中产阶级家庭已经下降到无产阶级的水平,而工人阶级家庭没有工作。第三帝国成为了被困者,那些失去了社会地位的人,以及那些为已经变得毫无意义的生存寻找新的基础的无根之人……的最后希望。

The economic background of the Hitler movement becomes apparent when one recalls that Hitler’s two revolutions coincided with Germany’s two great economic crises: the inflation of 1923 and the recession of the early 1930s, with its wave of unemployment. During the six intervening years, which were relatively prosperous for Germany, the Hitler movement was virtually non-existent.” [emphasis added]

The father of Pan-Europeanism and spiritual father of the European unx, Count Richard Coudenhove-Kalergi, often spoke well of Austrian and Italian fascism and even Catholic fascism, and thus the above quote by him takes on another layer of eeriness. Kalergi acknowledges that Hitler’s rise would not have been possible if there had not been two periods of extreme economic crisis for Germany. The question is, were these crises organic in their occurrence or rather engineered?

当人们回想起希特勒的两次革命与德国的两次大经济危机同时发生时,希特勒运动的经济背景就变得显而易见了:1923年的通货膨胀和20世纪30年代初伴随失业浪潮的经济衰退。在德国相对繁荣的六年里,希特勒运动几乎不存在。”

泛欧主义之父、欧盟精神之父理查德·库登霍夫-卡勒吉伯爵经常对奥地利和意大利法西斯主义,甚至天主教法西斯主义赞不绝口,因此他上面的这句话有了另一层诡异的意味。卡勒吉承认,如果德国没有经历两次极端的经济危机,希特勒的崛起是不可能的。问题是,这些危机是自然发生的,还是人为设计的?

In Kalergi’s 1954 autobiography “An Idea Conquers the World,” he writes: “there is not doubt that Hitler’s popularity rested mainly on the fanatical struggle which he waged against the Versailles Treaty.”

If we look at the political ecosystem Kalergi was navigating in, we get some hints to such a question, which included such men as Max Warburg, Baron Louis Rothschild, Herbert Hoover, Secretary of State Frank Kellogg, Owen D. Young, Bernard Baruch, Walter Lippmann, Colonel House, General Tasker Bliss, Hamilton Fish Armstrong, Thomas Lamont, Justice Hughes. All of these men are named by Kalergi directly as his support base in the United States in his autobiography. They were adamantly supportive of Kalergi’s Pan-Europeanism, aka a “United States of Europe,” were staunch supporters of a League of Nations vision and were architects within the Paris Peace Conference (1919-1920) which was responsible for the Treaty of Versailles which launched Germany into its first wave of extreme economic crisis. (For more on this story refer here.)

在卡勒吉1954年出版的自传《思想征服世界》中,他写道:“毫无疑问,希特勒的受欢迎程度主要取决于他对凡尔赛条约所进行的狂热斗争。”

如果我们看看卡勒吉所处的政治生态系统,我们就会得到一些关于这个问题的暗示,其中包括马克斯·华宝、路易斯·罗斯柴尔德男爵、赫伯特·胡佛、国务卿弗兰克·凯洛格、欧文·D·杨、伯纳德·巴鲁克、沃尔特·李普曼、豪斯上校、塔斯克·布利斯将军、汉密尔顿·菲什·阿姆斯特朗、托马斯·拉蒙特、休斯大法官。所有这些人都被卡勒吉在他的自传中直接列为他在美国的支持基础。他们坚定地支持卡勒吉的泛欧主义,又名“欧洲合众国”,是国际联盟愿景的坚定支持者,是巴黎和会(1919-1920)的设计者,该会议促成了凡尔赛条约,使德国陷入了第一波极端经济危机。

In my previous paper, “Is Japan Willing to Cut its Own Throat in Sacrifice to the U.S. Pivot to Asia?” I discussed how this is the very goal of the Trilateral Commission, to create economic crises in order to push through extreme structural reforms.

Financial analyst and historian Alex Krainer writes:

“The [Trilateral] commission was co-founded in July of 1973 by David Rockefeller, Zbigniew Brzezinski and a group of American, European and Japanese bankers, public officials and academics including Alan Greenspan and Paul Volcker. It was set up to foster close cooperation among nations that constituted the three-block architecture of today’s western empire. That ‘close cooperation’ was intended as the very foundation of the empire’s ‘three block agenda,’ as formulated by the stewards of the undead British Empire.”

在我之前的文章《日本愿意为美国重返亚洲战略自刎吗?》中,我讨论了三边委员会的目标是如何制造经济危机,以推动极端的结构改革。

金融分析师和历史学家Alex Krainer写道:1973年7月,戴维·洛克菲勒(David Rockefeller)、兹比格涅夫·布热津斯基(Zbigniew Brzezinski)和一群美国、欧洲和日本的银行家、政府官员和学者(包括艾伦·格林斯潘(Alan Greenspan)和保罗·沃尔克(Paul Volcker))共同创立了(三边)委员会。它的成立是为了促进各国之间的密切合作,这些国家构成了今天西方帝国的三层架构。这种‘密切合作’是大英帝国‘三大集团议程’的基础,是由不死的大英帝国的管理者制定的。”

Its formation would be organised by Britain’s hand in America, the Council on Foreign Relations (CFR), (aka: the offspring of the Royal Institute for International Affairs, the leading think tank for the British Crown).

On Nov 9th, 1978, Trilateral Commission member Paul Volcker (Federal Reserve Chairman from 1979-1987) would affirm at a lecture delivered at Warwick University in England: “A controlled disintegration in the world economy is a legitimate obxt for the 1980s.” This is also the ideology that has shaped Milton Friedman’s “Shock Therapy”.

In 1975 the CFR launched a public study of global policy titled the 1980’s Project. The general theme was “controlled disintegration” of the world economy, and the report did not attempt to hide the famine, social chaos, and death its policy would bring upon most of the world’s population.

This is precisely what Japan has been undergoing, and which economist Richard Werner demonstrated in his book Princes of Yen, to which a documentary by the same name was made. That Japan’s economy was put through a manufactured bubble in order to create an economic crisis that would then justify the need for extreme structural reform.

它的成立将由英国在美国的外交关系委员会(CFR)组织(又名:皇家国际事务研究所的产物,英国王室的主要智库)。

1978年11月9日,三边委员会成员保罗·沃尔克(1979-1987年担任美联储主席)在英国华威大学的一次演讲中肯定地说:“世界经济在可控范围内解体是上世纪80年代的一个合理目标。”这也是米尔顿·弗里德曼提出“休克疗法”的意识形态。

1975年,CFR发起了一项名为“80年代计划”的全球政策公开研究。报告的主题是世界经济的“可控的解体”,报告并没有试图掩盖其政策将给世界大部分人口带来的饥荒、社会混乱和死亡。

这正是日本一直在经历的事情,经济学家理查德·维尔纳在他的著作《日元的王子》中阐述了这一点,该书还被拍成了同名纪录片。日本经济经历了人为制造的泡沫,目的是制造一场经济危机,从而证明极端结构改革的必要性。

We will now briefly discuss how the United States, the Tiger Economies and Europe have also been put through the same process of manufactured economic crises and what this means for the world today, what has been the consequence for Europe in following a “United States of Europe” model and how does the one world government model of a League of Nations differ from the multipolar frxwork made up of sovereign nation states. I will conclude this paper with remarks on why Shinzo Abe was assassinated.

Colonialism 2.0: The Asian Economic Crisis of the Tiger Economies

Japan was not the only high-performance economy in Asia that in the 1990s found itself in the deepest recession since the Great Depression. In 1997, the currencies of the Southeast Asian Tiger Economies could not maintain a fixed exchange rate with the U.S. dollar. They collapsed by between 60-80% within a year.

The causes for this crash went as far back as 1993. In that year, the Asian Tiger Economies – South Korea, Thailand, Indonesia – implemented a policy of aggressive deregulation of their capital accounts and the establishment of international banking facilities, which enabled the corporate and banking sectors to borrow liberally from abroad, the first time in the postwar era that borrowers could do so. In reality, there was no need for the Asian Tiger Economies to borrow money from abroad. All the money necessary for domestic investment could be created at home.

现在,我们将简要讨论美国、“四小龙”和欧洲是如何经历同样的人为制造的经济危机过程的,这对当今世界意味着什么,欧洲遵循“欧洲合众国”模式的后果是什么,国际联盟的一个世界政府模式与由主权民族国家组成的多极框架有何不同。在本文的结尾,我将对安倍晋三为何被暗杀发表评论。

殖民主义2.0:亚洲四小龙经济危机

日本并不是上世纪90年代陷入大萧条以来衰退最严重的唯一表现优异的亚洲经济体。1997年,“东南亚四小龙”的货币无法与美元保持固定汇率。他们在一年之内暴跌了60-80%。

这场危机的原因可以追溯到1993年。那一年,亚洲“四小虎”(韩国、泰国和印度尼西亚)实施了一项政策,积极放松对资本账户的管制,并建立了国际银行设施,使企业和银行部门能够自由地从国外借款,这是战后借款人第一次可以这样做。事实上,亚洲四小虎经济体没有必要从国外借钱。国内投资所需的所有资金都可以在国内创造。

The Princes of Yen documentary remarks:

“Indeed the pressure to liberalise capital flows came from outside. Since the early 1990s, the IMF, the World Trade Organization and the U.S. Treasury had been lobbying these countries to allow domestic firms to borrow from abroad. They argued that neoclassical economics had proven that free markets and free capital movement increased economic growth.

Once the capital accounts had been deregulated, the central banks set about creating irresistible incentives for domestic firms to borrow from abroad by making it more expensive to borrow in their own domestic currencies than it was to borrow in U.S. dollars.

《日元王子》纪录片摘要:

“事实上,开放资本流动的压力来自外部。自上世纪90年代初以来,IMF、世界贸易组织和美国财政部一直在游说这些国家允许本国企业从国外借款。他们认为,新古典经济学已经证明,自由市场和自由资本流动可以促进经济增长。

一旦资本账户被解除管制,中央银行就开始创造不可抗拒的激励机制,鼓励国内企业从国外借款,方法是让本币借款的成本高于美元借款的成本。

The central banks emphasised in their public statements that they would maintain fixed exchange rates with the U.S. dollar, so that borrowers did not have to worry about paying back more in their domestic currencies than they had originally borrowed. Banks were ordered to increase lending. But they were faced with less loan demand from the productive sectors of the economy, because these firms had been given incentives to borrow from abroad instead. They therefore had to resort to increasing their lending to higher-risk borrowers.

Imports began to shrink, because the central banks had agreed to peg their currencies to the U.S. dollar. The economies became less competitive, but their current-account balance was maintained due to the foreign issued loans, which count as exports in the balance-of-payments statistics. When speculators began to sell the Thai baht, the Korean won and the Indonesian rupee, the respective central banks responded with futile attempts to maintain the peg until they had squandered virtually all of their foreign exchange reserves. This gave foreign lenders ample opportunity to withdraw their money at the overvalued exchange rates.

The central banks knew that if the countries ran out of foreign exchange reserves, they would have to call in the IMF to avoid default. And once the IMF came in, the central banks knew what this Washington-based institution would demand, for its demands in such cases had been the same for the previous three decades: the central banks would be made independent [and subservient to the IMF diktat].

各国央行在公开声明中强调,他们将维持与美元的固定汇率,这样借款人就不必担心以本币偿还的金额超过他们最初的借款金额。银行被要求增加贷款。但它们面临着来自经济生产部门的贷款需求减少,因为这些公司被鼓励从国外借款。因此,他们不得不增加对高风险借款人的贷款。

进口开始萎缩,因为各国央行同意将本国货币与美元挂钩。这些经济体的竞争力下降了,但由于外国发行的贷款,它们的经常账户保持了平衡,这些贷款在国际收支统计中被算作出口。当投机者开始抛售泰铢、韩圆和印尼卢比时,各自的央行都徒劳地试图维持盯住美元的汇率制度,直到挥霍掉几乎所有的外汇储备。这让外国银行有足够的机会以被高估的汇率撤出资金。

各国央行知道,如果这些国家耗尽了外汇储备,它们将不得不求助于IMF以避免违约。一旦IMF加入,各国央行就知道这家总部位于华盛顿的机构会提出什么要求,因为在这种情况下,IMF的要求与过去30年是一样的:央行将变得独立(并服从IMF的命令)。

On the 16th of July the Thai Finance Minister took a plane to Tokyo to ask Japan for a bailout. At the time Japan had USD $213 billion in foreign exchange reserves, more than the total resources of the IMF. They were willing to help but Washington stopped Japan’s initiative. Any solution to the emerging Asian Crisis had to come from Washington via the IMF.

After two months of speculative attacks the Thai government floated the baht.

The IMF to date has promised almost $120 billion USD to the embattled economies of Thailand, Indonesia and South Korea. Immediately upon arrival in the crisis-stricken countries, the IMF teams set up offices inside the central banks, from where they dictated what amounted to terms of surrender. The IMF demanded a string of policies, including curbs on central bank and bank credit creation, major legal changes and sharp rises in interest rates. As interest rates rose, high risk borrowers began to default on their loans.

Burdened with large amounts of bad debts, the banking systems of Thailand, Korea, and Indonesia were virtually bankrupt. Even otherwise healthy firms started to suffer from the widening credit crunch. Corporate bankruptcies soared. Unemployment rose to the highest levels since the 1930s.”

7月16日,泰国财政部长乘飞机前往东京,请求日本提供紧急援助。当时日本拥有2130亿美元的外汇储备,比IMF的总资源还要多。他们愿意提供帮助,但华盛顿阻止了日本的倡议。对于正在出现的亚洲危机的任何解决方案都必须来自华盛顿,通过IMF。

经过两个月的投机攻击,泰国政府让泰铢自由浮动。

到目前为止,IMF已经承诺向陷入困境的泰国、印度尼西亚和韩国提供近1200亿美元的资金。IMF的团队一抵达遭受危机打击的国家,就在这些国家的央行内设立了办公室,在那里他们决定投降的条件是什么。IMF要求采取一系列政策,包括限制央行和银行信贷创造、重大法律改革以及大幅提高利率。随着利率上升,高风险借款人开始拖欠贷款。

泰国、韩国和印尼的银行体系背负着巨额坏账,实际上已经破产。甚至在其他方面健康的公司也开始受到信贷紧缩的影响。企业破产激增。失业率上升到20世纪30年代以来的最高水平。”

The IMF knew well what the consequences of its policies would be. In the Korean case, they even had detailed but undisclosed studies prepared, that had calculated just how many Korean companies would go bankrupt if interest rates were to rise by five percentage points. The IMF’s first agreement with Korea demanded a rise of exactly five percentage points in interest rates.

Richard Werner stated in an interview: “The IMF policies are clearly not aimed at creating economic recoveries in the Asian countries. They pursue quite a different agenda and that is to change the economic, political and social systems in those countries. In fact, the IMF deals prevent the countries concerned, like Korea, Thailand, to reflate.”

Interviewer: “Interesting. So you’re saying it’s making the crisis worse and you’re suggesting that the IMF has a hidden agenda?”

IMF很清楚其政策的后果。在韩国的案例中,他们甚至准备了详细但未公开的研究,计算出如果利率上升5个百分点,将有多少韩国公司破产。IMF与韩国的第一份协议要求将利率上调5个百分点。

理查德·沃纳在接受采访时表示:“IMF的政策显然不是为了让亚洲国家经济复苏。他们追求完全不同的议程,那就是改变这些国家的经济、政治和社会制度。事实上,IMF的协议阻止了有关国家,如韩国、泰国,通货再膨胀。”

采访者:“有趣。所以你是说这让危机变得更糟,你是在暗示IMF有隐藏的议程?”

Richard Werner responded: “Well, it’s not very hidden this agenda because the IMF quite clearly demands that the Asian countries concerned have to change the laws so that foreign interests can buy anything from banks to land. And in fact, the banking systems can only be recapitalised, according to the IMF deals, by using foreign money which is not necessary at all, because as long as these countries have central banks, they could just print money and recapitalise the banking systems. You don’t need foreign money for that. So the agenda is clearly to crack open Asia for foreign interests.”

The IMF demanded that troubled banks not be bailed out, but instead closed down and sold off cheaply as distressed assets, often to large U.S. investment banks. In most cases the IMF-dictated-letters-of-intent explicitly stated that the banks had to be sold to foreign investors.

In Asia, government organised bailouts to keep ailing financial institutions alive were not allowed. But when a similar crisis struck back home in America a year later, the very same institutions reacted differently.

理查德·沃纳回应:“嗯,这个议程并不是很隐蔽,因为IMF非常明确地要求有关亚洲国家必须修改法律,所以外国利益集团可以购买任何东西,从银行到土地。事实上,根据IMF的协议,银行系统只能通过使用外国货币来进行资本重组,这根本不是必要的,因为只要这些国家有中央银行,他们就可以印发货币,对银行系统进行资本重组。你不需要为此用到外国资金。因此,议程显然是为外国利益打开亚洲大门。”

IMF要求不救助陷入困境的银行,而是将其关闭,作为不良资产廉价出售,通常卖给美国大型投资银行。在大多数情况下,IMF口授的意向书明确规定,银行必须出售给外国投资者。

在亚洲,政府组织救助以维持境况不佳的金融机构的做法是不被允许的。但一年后,当一场类似的危机在美国本土袭来时,同样的机构却做出了不同的反应。

The Princes of Yen documentary remarks:

“The Connecticut based hedge fund Long-Term Capital Management, which accepted as clients only high-net-worth individual investors and institutions, had leveraged its $5 billion USD in client capital, by more than 25 times, borrowing more than $100 billion USD from the world’s banks. When its losses had threatened to undermine the banks that had lent to it, with the possibility of a systemic banking crisis that would endanger the U.S. financial system and economy, the Federal Reserve organised a cartel-like bailout by leaning on Wall Street and international banks to contribute funds so that it could avoid default.

Why would the United States make demands on foreign nations in the name of the free market, when it has no intention of enforcing the same rules within its own borders?

The examples of the Japanese and Asian crises illustrate how crises can be engineered to facilitate the redistribution of economic ownership, and to implement legal, structural and political change.”

《日元王子》纪录片摘要:

总部位于康涅狄格州的对冲基金长期资本管理公司,只接受高净值个人投资者和机构作为客户,将其50亿美元的客户资本杠杆化了25倍以上,从世界银行借款超过1000亿美元。当它的损失威胁到向它提供贷款的银行时,有可能发生系统性的银行危机,危及美国的金融体系和经济,美联储组织了一个卡特尔式的救助,依靠华尔街和国际银行提供资金,以避免违约。

为什么美国要以自由市场的名义向外国提出要求,而它并不打算在自己的境内执行同样的规则?

日本和亚洲金融危机的例子表明,如何利用危机来促进经济所有权的重新分配,并实施法律、结构和政治变革。”

The reason why the Asian banks were forbidden to be saved, was so there could be a foreign buy-out of these Asian economies. Who needed the British East-India Co. when you now had the IMF ensuring the empire’s colonial obxtives?

The IMF and Trilateral Commission’s “not so Hidden” Agenda

The IMF has clearly set its sights on a western banking take-over of Asia, but what was the “agenda” for Europe and the United States who were located within this sphere of influence? Were they destined to benefit from the plunders of the empire?

The short answer to this, which should be evident by now, is no.

亚洲银行禁止被拯救的原因,是为了让外资收购这些亚洲经济体。当你现在有IMF来确保帝国的殖民目标时,谁还需要英国的东印度公司呢?

IMF和三边委员会的“不那么隐蔽”议程

IMF的目标显然是西方银行业接管亚洲,但处于这一影响范围内的欧洲和美国的“议程”是什么?他们注定要从帝国的掠夺中获益吗?

对这个问题的简短回答是否定的,这一点现在应该很明显了。

The manufactured crises in the United States and Europe were to further centralise power amongst an ever smaller grouping and clearly not for the benefit of the people, or shall we say subjects of the land, who happen to be living in these regions.

Europe has particularly done a number on itself due to its adherence to a “United States of Europe” vision. Countries within the Euro currency bloc had forfeited their right to a national currency and handed this power to the European Central Bank (ECB), the most powerful and secretive of all central banks.

美国和欧洲人为制造的危机是为了进一步将权力集中在一个越来越小的集团中,显然不是为了人民的利益,或者我们应该说,土地上的臣民,他们碰巧生活在这些地区。

由于坚持“欧洲合众国”的愿景,欧洲在自己身上做了很多事情。欧元区内的国家丧失了使用本国货币的权利,将这种权力交给了欧洲中央银行(ECB)——所有中央银行中最强大、最隐秘的一家。

Under such a system, no European country has control over its own economy and is completely exposed to whatever the ECB decides.

Richard Werner remarked: “They [ECB] have to focus more on credit creation rather than interest rates. The ECB has a lot to learn from its past mistakes, because basically I don’t think it really watched credit creation carefully enough. Where in Spain, Ireland, we had massive credit expansion, under the watch of the ECB, interest rates are of course the same in the Eurozone, but the quantity of credit cycle is very different…There is one interest rate for the whole euro area but in 2002 the ECB told the Bundesbank [central bank of Germany] to reduce its credit creation by the biggest amount in its history and told the Irish central bank to print as much money as if there was no tomorrow. What do you expect is going to happen? Same interest rate. Is it the same growth? No. Recession in Germany, boom in Ireland. Which variable tells you that? Credit creation.”

在这种体制下,没有哪个欧洲国家能够控制自己的经济,完全受制于欧洲央行的决定。

理查德·沃纳说:“他们(欧洲央行)必须更多地关注信贷创造,而不是利率。欧洲央行可以从过去的错误中吸取很多教训,因为基本上我认为它没有足够仔细地观察信贷创造。在西班牙和爱尔兰,我们有大规模的信贷扩张,在欧洲央行的监管下,欧元区的利率当然是一样的,但信贷周期的数量有很大不同……整个欧元区只有一个利率,但在2002年,欧洲央行要求德国央行以历史上最大的幅度减少信贷创造,并要求爱尔兰央行尽可能多地印钞,就好像没有明天一样。你期望会发生什么?同样的利率。是相同的增长吗?不。德国经济衰退,爱尔兰经济繁荣。哪个变量告诉你这个?信贷创造。”

评论翻译

很赞 ( 0 )

收藏